In a report by international trade legal firm, Tereposky & DeRose LLP, they do a deep dive on various investigations carried out by Canada Border Services Agency (CBSA). The investigations were kicked off at the end of last year (Dec 2020) under the Special Import Measures Act (SIMA).

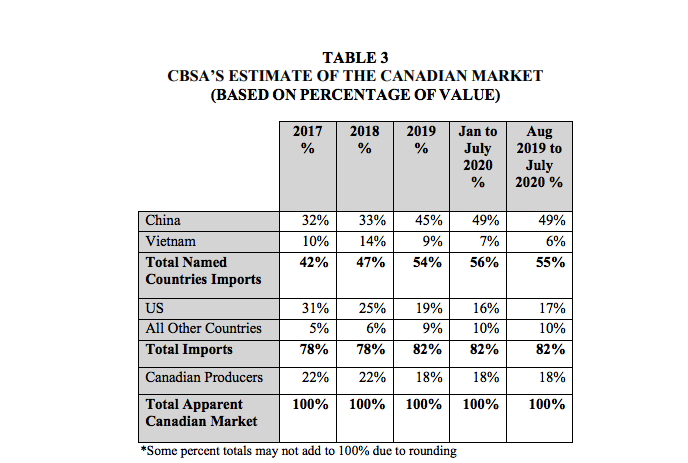

Upholstered domestic seating makes up a healthy portion of the Canadian trade economy, so keeping things compliant is incredibly important to the health of the importer. See the chart below!

What is SIMA?

SIMA is a regulatory framework that was put forth to protect Canada’s industries from damaging practices like dumping and subsidizing importer goods, which helps keep Canada’s economy strong. As CBSA puts it: “[It will] help Canadian producers who face unfair foreign competition in the Canadian marketplace.”

SIMA is also known as Anti-Dumping and Countervailing. If you’d like to read more about this topic, check these pieces out:

Trade Protectionism In Canada: Anti-Dumping & Countervailing

CBSA’s resources:

- Guide for Self-Assessing SIMA Duties

- Guide for Appealing a Duty Assessment

- Information About Penalties (AMPS)

All investigations by CBSA are made public and can be assessed here. It is critical that importers stay privy to the results of these investigations, as they may cause issues for imports into Canada, depending on the goods in question. And further to the initiation of the investigation, the ruling is even more important to take note of, as they may require a change in your importing practices.

What was the focus of the Dec 2020 CBSA investigation (UDS 2020 IN)?

The investigation was instigated due to various alleged injurious dumping and subsidizing on imports from China and Vietnam. The goods in question were domestic upholstered seating, due to a complaint filed by Palliser Furniture Ltd, of Winnipeg. As you may have gleaned from the name, Palliser Furniture mainly sells couches, chairs, and other pieces of furniture.

Tereposky & DeRose LLP further elaborates that:

“The subject goods are usually classified under the following tariff classification numbers: 9401.40.00.00; 9401.61.10.10; 9401.61.10.90; 9401.71.10.10; and 9401.71.10.90.

The product definition provides that the subject goods are any upholstered seating used for domestic purposes that originate in or are exported from China and Vietnam. This definition extends to include both stationary and “motion” seating.

[…Including, but not limited to seating such as sofas, chairs, loveseats, sofa‑beds, day‑beds, futons, ottomans, stools and home‑theatre seating (“HTS”)]”

Domestic purposes was a term defined within the Schedule to the Canadian Customs Tariff (Chapter 94). And has already been applied in a previous appeal by Stylus Sofas in 2013.

What was decided?

Earlier this year, CBSA made the decision on the investigation UDS 2020 IN. The alleged injurious dumping and subsidization of certain domestic seating from China and Vietnam was respected, pursuant to stipulations in SIMA.

You may examine the entire Complaint Analysis & Statement of Reasons in this document by CBSA.

“This program was specifically identified by the complainant citing the USDOC final determination in the countervailing duty investigation of Laminated Woven Sacks from Vietnam. Although the CBSA did not list this as a specific program to be investigated in either Copper Pipe Fittings 2, Cold-Rolled Steel or Corrosion-Resistant Steel Sheet 2, the CBSA investigated state-provided utilities and whether exporters were offered preferred utility rates.”

—

Staying apprised of these investigations is critical for importers in Canada. Partnering with an experienced customs broker that are, by definition, experts in navigating regulatory shifts in Canada can help you clear Canada customs with ease. Click here to start a conversation.

Payment

Payment  My Account

My Account