Starting on Oct. 1, 2022, an excise duty or “Vape Tax” will come into effect on vaping substances that are imported into Canada with the intention of being used in vaping devices, as well as vaping substances that are manufactured in Canada.

The vaping duty was first announced in the 2022 Federal Budget.

As an importer, what do I have to do?

If you import packaged vaping products into the Canadian duty-paid market, you must apply to the CRA to become a “vaping prescribed person” to obtain vaping excise stamps.

(Note: If you are an importer but also manufacture vaping products in Canada, you must get a vaping product license instead of applying to be a vaping prescribed person.)

Packaged vaping products that are intended for the duty-paid market must be stamped prior to being imported into Canada.

Eligible vaping products that are not stamped must be entered into a sufferance warehouse for the purpose of being stamped.

How do I calculate the vaping duty?

For vaping products imported into Canada, the person liable to pay the duty under the Customs Act must calculate the vaping duty to determine the amount payable to the Canada Border Services Agency (CBSA) at the time of importation.

The rates are as follows:

For vaping liquids:

- $1 per 2 millilitres (mL), or fraction thereof, for the first 10 mL of vaping substance in the vaping device or immediate container

- $1 per 10 mL, or fraction thereof, for amounts over the first 10 mL

For vaping solids:

- $1 per 2 grams (g), or fraction thereof, for the first 10 g of vaping substance in the vaping device or immediate container

- $1 per 10 g, or fraction thereof, for amounts over the first 10 g

For example:

A package containing 4 pods, with each pod containing 1.5 mL of vaping liquid, attracts $4 of vaping duty ($1 per 1.5 mL pod).

A 30 mL bottle of vaping liquid attracts $7 of vaping duty ($5 for the first 10 mL plus $2 for the next 20 mL).

Note: The vaping duty is calculated on the quantity of vaping liquid contained in each individual pod, not on the total volume contained in the package.

For further reading:

Vaping prescribed person L603 application form

Applying as an importer of vaping products

Excise duty on vaping products

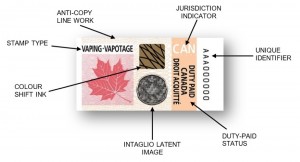

Overview of vaping excise stamps

To stay informed on import duties and other important updates, PARTNER UP WITH A CUSTOMS BROKER HERE

Payment

Payment  My Account

My Account