As cross-border trade between Canada and the U.S. continues to grow, so does regulatory scrutiny. In 2025, Canadian importers and exporters now face stricter U.S. Customs and Border Protection (CBP) enforcement — and a surge in post-entry audits.

From USMCA origin verification to IEEPA tariff refunds and valuation checks, compliance standards are tightening, and Canadian businesses must adapt before the audit letter arrives.

This article breaks down what’s driving this wave of audits, what types of compliance risks are under the microscope, and how your business can stay one step ahead.

Why U.S. Customs Audits Are Increasing in 2025

Two major trends are fueling the rise in U.S. customs audits:

The End of the De Minimis Threshold

With the elimination of the U.S. $800 De Minimis threshold, millions of new shipments that once entered the U.S. duty-free now require formal customs clearance. That’s a massive data influx for CBP to monitor, and an opportunity for enforcement teams to identify anomalies.

Canadian sellers and importers sending goods south of the border should expect more documentation reviews, valuation questions, and USMCA origin checks than ever before.

Data-Driven and AI-Based Enforcement

CBP and the Canada Border Services Agency (CBSA) now use advanced analytics and AI tools to flag inconsistencies in tariff classification, country of origin, and declared values. This means even minor discrepancies, like mismatched HS codes or incomplete origin statements, can trigger audits.

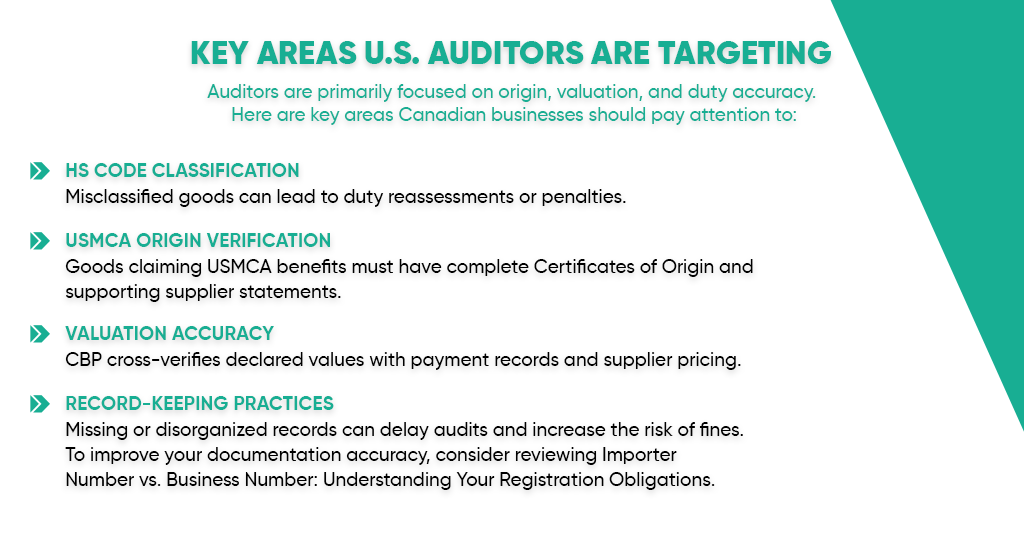

Key Areas U.S. Auditors Are Targeting

Auditors are primarily focused on origin, valuation, and duty accuracy. Here are key areas Canadian businesses should pay attention to:

HS Code Classification:

Misclassified goods can lead to duty reassessments or penalties.

USMCA Origin Verification

Goods claiming USMCA benefits must have complete Certificates of Origin and supporting supplier statements.

Valuation Accuracy

CBP cross-verifies declared values with payment records and supplier pricing.

Record-Keeping Practices

Missing or disorganized records can delay audits and increase the risk of fines.

To improve your documentation accuracy, consider reviewing Importer Number vs. Business Number: Understanding Your Registration Obligations.

How Canadian Businesses Can Build Audit-Ready Compliance

Preparing for stricter enforcement doesn’t just mean reacting to audits — it means building a proactive compliance culture. Here’s how:

Digital Record Management

Keep all trade documents, invoices, origin certificates, shipping records, stored digitally for at least five years. Digital organization makes retrieval easy in case of a CBP or CBSA request.

Explore how technology supports compliance in Digital Customs Tools for Seamless Trade.

HS Code Standardization

Ensure every product has a consistent classification. Even small variations across orders or platforms can raise red flags.

Supply Chain Audit Programs

Conduct internal “mock audits” to verify supplier documentation, proof of origin, and declared values. These reviews can uncover risks before regulators do.

Stay Updated on Duty Relief Programs

If your imports qualify for duty remission, use legitimate channels to minimize exposure. Learn more through Canada Duty Remission and Relief Programs.

Common Mistakes That Trigger Audits

Many businesses attract unwanted attention simply by overlooking simple details. Avoid these common pitfalls:

- Using outdated Certificates of Origin for USMCA claims

- Declaring round or inconsistent invoice values

- Ignoring changes to tariff schedules or duty rates

- Submitting incomplete export documentation from Canada

- Relying on courier-generated forms without verifying accuracy

Even small oversights can lead to refund delays, penalties, or supply chain disruption, particularly as CBP becomes more aggressive in its post-entry verification process.

Building a Strong Internal Compliance Program

For growing e-commerce brands and SMBs, establishing an internal trade compliance policy is no longer optional. These programs ensure consistency across departments, suppliers, and documentation systems.

A solid compliance program should include:

- Designated compliance officers or staff

- Clear document retention procedures

- Supplier verification protocols

- Regular training on USMCA and tariff updates

Strong compliance doesn’t just prevent penalties, it builds trust with U.S. buyers and partners, ensuring your business is audit-ready at all times.

Conclusion

The enforcement environment in 2025 is clear: data accuracy, documentation consistency, and proactive compliance are the new trade essentials.

Canadian importers and exporters who build transparency into their processes will not only avoid penalties, they’ll gain a competitive edge in cross-border trade.

Stay ahead of audits, not behind them. Review your documentation, verify supplier compliance, and make sure your business is ready for the next wave of U.S. customs enforcement.

Stay compliant and confident — manage your cross-border audits effortlessly with Clearit Canada Online Platform.

FAQs

Q1: How often do CBP or CBSA audits occur?

Audits can happen randomly, but higher-risk importers, such as those with inconsistent filings or frequent low-value shipments, are targeted more often.

Q2: What records should I keep?

Maintain all invoices, origin documentation, shipping data, and broker filings for at least five years from the date of import.

Q3: Can small e-commerce sellers be audited?

Yes. Even small-volume importers and Amazon FBA sellers fall under CBP’s enforcement scope, especially after the end of De Minimis exemptions.

Q4: What’s the penalty for non-compliance?

Penalties range from administrative delays to monetary fines or suspension of preferential trade privileges under USMCA.

Payment

Payment  My Account

My Account