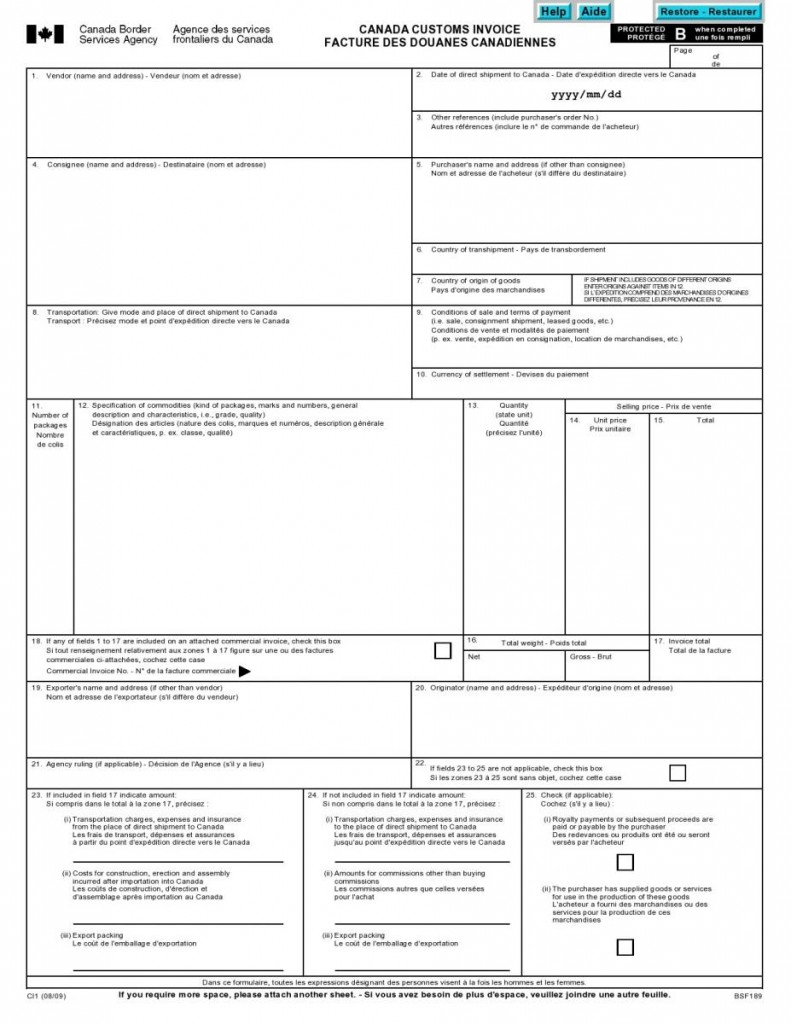

In order to import any shipment into Canada you’ll need a Canada Customs Invoice (CCI) form. In order to avoid having your shipment delayed at the border, a properly filled form with correct and accurate information is your best tool.

Required Fields

The CCI form is composed of various sections – some of which are absolutely required in order to obtain customs clearance. The below information needs to be declared at the time of release:

- Value: You should indicate in this part the market value of the goods you wish to import. This is mandatory information even if there is no sale involved. The value should be based on one of the following six valuation methods: residual method, computed method, deductive method, the transaction value of the goods, identical goods or similar goods.

- Quantity: Indicating the proper number of items / pieces being shipped will help streamline the import process. If Customs officers decide to examine your shipment, you’ll want to be sure that what’s on the form matches what’s in the boxes.

- Country of origin of goods: You’ll need to indicate where the goods you’re importing originate from or where they were manufactured. Note that this isn’t where the goods are being imported from – there’s a small difference. Due to the fact Canada has various trade agreements set up, specifying the country of origin will allow to determine if any trade agreements can be applied to lessen fees and tariffs.

- Weight: It is imperative that the weight indicated on the CCI matches up with the weight indicated on the carrier’s bill of lading. In case of a customs examination, this information can be used to verify accuracy.

- Purchaser / Importer of Record: This will indicate who has purchased the goods, who’s responsible for handling the import details such as clearance and duty and accountable for any fees or taxes applicable to goods imported.

- Currency of sale: This field should indicate in which funds the goods were purchased with. Customer brokers will need to convert the funds into Canadian currency for goods being imported into Canada. Don’t leave this field blank.

- Date of Direct Shipment: As currency rates change daily, Customs require this date in order to obtain the rate used to determine the duty in Canadian funds. The date is the date the goods left the place of direct shipment.

Although the CCI form isn’t a very long form in terms of size, it truly is an important one to have in hand to minimize any potential delays at the border. Your customs broker can help you obtain the right information and fill out correctly the form to allow you to make it through customs like a breeze.

Looking for documents for your shipment? Click Here

Payment

Payment  My Account

My Account