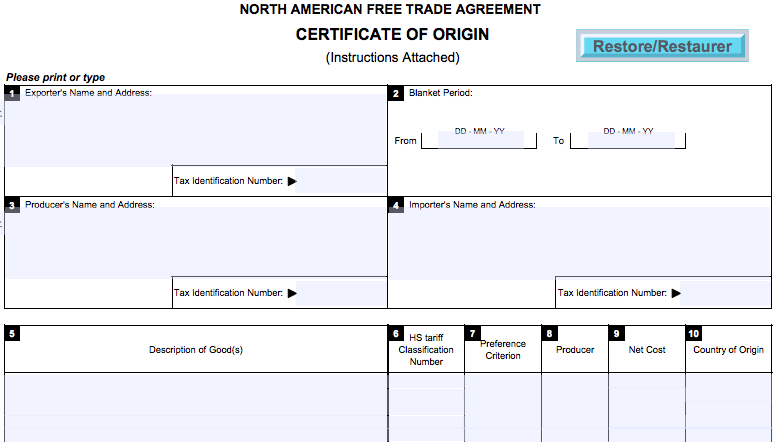

Information sharing with various government agencies and regulators is part of the import-export business, it’s something many businesses feel like they can do with a blindfold on; include some shipping or invoicing data here, throw in the name of the shipper there and the consignee here and then send off the forms. It seems pretty easy and for businesses that do it on a regular basis it truly is routine, but what about the North American Free Trade Agreement (NAFTA) and its requirements? Is it that simple too?

It seems like most of the information required is relatively the same : you need to supply information about the exporter, the producer, maybe the importer, a description of the goods, etc. It’s just a matter of knowing what to write and where right?

Sorry, wrong.

The information you’re going to include isn’t just the same, it actually needs to qualify under NAFTA. Of course, when it comes to an international trade agreement, there are rules that need to be followed. To help better understand the requirements here is a list of the top 5 most common mistakes on the NAFTA Certificate of origin and how to avoid them. Follow these few steps and avoid a few headaches.

Top 5 most common mistakes on the NAFTA Certificate of origin

-

Field 6 – The Harmonized System (H.S.) Tariff Classification Number

Each product needs to have the H.S. Tariff classification correctly assigned to it. The first six digits will determine which of the NAFTA ”Rules of Origin” apply, so these need to be correct the first time around. If you’re unsure of the classification that applies, seek help from your customs broker.

-

Field 7 – Preference Criterion

The information you’ll include in this field will depend on where a product was sourced or manufactured, details regarding the extent of the manufacturing process and transformation and the source and place of any raw materials. Each product needs careful attention when comes time to chose the preference criterion because what’s good for one, might not be the best for another. Each situation and product is worth being evaluated on its own.

-

Field 8 – Producer

On your end, this should be an easy one; there are three ‘NO’ answers to be given and here’s what’s it all about. Your first NO refers to the fact that you are basing your claim on the fact that you just know that’s NAFTA eligible, the second NO is based on you having documentation from the producer that is NAFTA eligible (other than the Certificate of origin), the third NO is you voluntarily providing and accurately completed NAFTA Certificate of Origin from the manufacturer. It is recommended to go with the third option because it assures authorities that the producer did his job on his end and confirmed already that his product, the one he is providing you, is NAFTA eligible.

-

Field 9 – Net Cost

A good understanding of the NAFTA ”Specific Rules of Origin” will help navigate through this question with a lot more ease. The rule sin question will help you determine if Regional Value Content is a key factor and if the Net Cost method is the best route to take. You will either indicate in this section ‘NC’ if you used the Net Cost method – otherwise ‘NO’ (which applies to all other situations). It’s important not to place a dollar amount in the field, because customs officials will realize you just didn’t read the instructions when filling in your forms.

-

Field 10 – Country of Origin

It would seem pretty basic to understand that NAFTA covers North America, not Asia, not Europe, just good old Canada, the U.S. and Mexico. But still, some businesses out there are sending in paperwork with countries of origin that aren’t part of the Three Amigos Pact. Another mistake related to the Country of Origin is believing that because the product is made in the U.S., Canada or Mexico, it automatically qualifies for NAFTA…wrong. The fact is, if the product does not qualify, it needs to be in this document.

Avoid Nightmares

A worst case scenario when it comes to NAFTA could be something like : importing a product for years, assuming that it fits under NAFTA rules, only to find out after a customs audit, that the product in question doesn’t qualify. In such a case, you could be looking at duties from either side of the border, which can range from duty-free to over 200% and let’s not forget fines and penalties. Doesn’t souns like much fun, right?

Customers brokers are your best allies when it comes to understanding the various rules and regulations enclosed within a free trade agreement. If it’s not NAFTA that’s causing you a headache, maybe another agreement is what you’re looking into – be careful also as most of these regulations and their forms, especially the Certificates of Origin, are fairly similar.

Need some advice on what to keep an eye out for in your forms to avoid scares and nightmares? Click Here to learn more about our Customs Consulting service

Looking for Free Trade Agreement docs? Click Here

Payment

Payment  My Account

My Account