Jewelry and watches are among the most frequently imported luxury goods into Canada, but they are also some of the most misunderstood from a compliance perspective. Many importers assume these products clear like standard retail items, only to encounter unexpected duties, valuation scrutiny, or CBSA holds.

In 2026, enforcement around valuation accuracy, country-of-origin claims, and product classification has intensified. Whether you are launching a jewelry brand, scaling an e-commerce store, or sourcing watches from overseas manufacturers, understanding the rules before shipping is essential.

This guide explains the duties, documentation, and regulatory considerations involved in importing jewelry and watches into Canada, along with how to avoid costly border mistakes.

Why Jewelry Imports Receive Extra Attention

Jewelry imports receive extra CBSA attention due to high value, material sensitivity, and increased risk of undervaluation.

Jewelry shipments often attract higher scrutiny because they:

- Carry high value relative to size

- Are vulnerable to undervaluation

- May involve precious metals or gemstones

- Can be subject to trade preference claims

- Are common targets for duty evasion

Even minor declaration errors can trigger document reviews or physical inspections.

To better understand how border delays typically occur and what triggers inspections, read this blog.

Understanding Duties on Jewelry and Watches

Duty rates vary significantly depending on material composition and origin.

Typical ranges include:

- Imitation jewelry: Often 6%–8%

- Precious metal jewelry: Frequently duty-free when qualifying under trade agreements

- Watches: Typically, 4%–8%, depending on components

- Smartwatches: May be classified as electronic devices depending on functionality and connectivity

On top of duty, importers must also pay:

- GST (5%)

- Provincial taxes where applicable

Because margins in jewelry can be tight, even small duty miscalculations can impact profitability.

Country of Origin Matters More Than You Think

If your products qualify under trade agreements such as CUSMA (formerly NAFTA), you may benefit from reduced or zero duties.

However, origin claims must be supported by proper documentation. Incorrect declarations can result in reassessments and penalties.

You can learn how to avoid paying unnecessary duties here.

HS Classification: One of the Most Common Mistakes

Jewelry classification is rarely straightforward.

CBSA evaluates:

- Primary material (gold, silver, platinum, steel, etc.)

- Whether gemstones are natural or synthetic

- Functional vs. decorative purpose

- Watch movement type

- Strap material

For example:

- A gold-plated bracelet is classified differently from solid gold.

- A fashion watch is treated differently from a luxury mechanical watch.

Misclassification can lead to:

- Back duties

- AMPS penalties

- Shipment delays

- Post-entry corrections

Valuation: Where Importers Often Get Into Trouble

CBSA expects the declared value to reflect the true transaction price.

Red flags include:

- Artificially low supplier invoices

- Missing royalty payments

- Side agreements

- Bundled pricing

- Transfer pricing inconsistencies

Jewelry shipments are especially prone to valuation audits because pricing varies widely and is often influenced by branding, craftsmanship, and material composition.

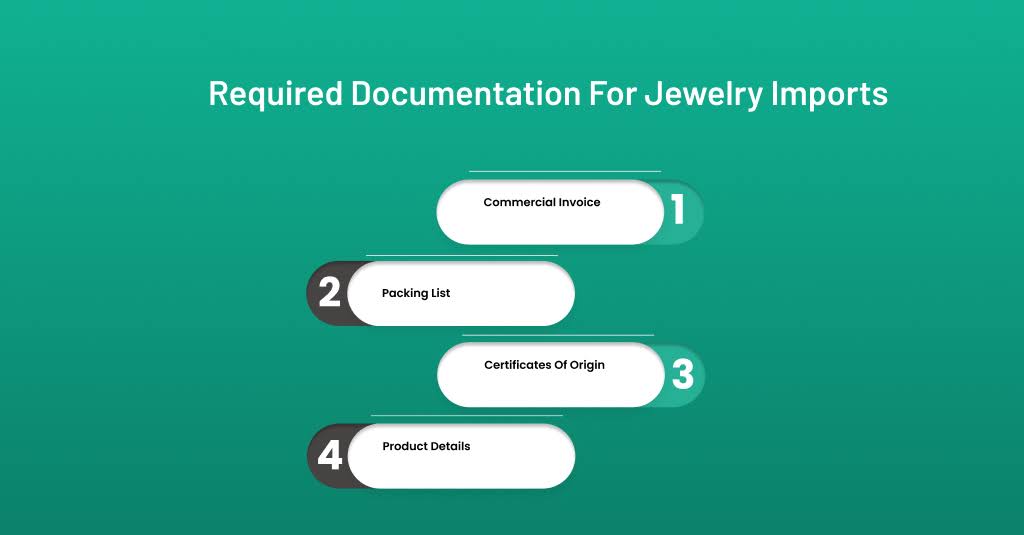

Required Documentation for Jewelry Imports

Complete and accurate documentation is essential when importing jewelry and watches into Canada.

Accurate documentation is your first line of defense against delays.

Commercial Invoice

Your invoice should clearly list:

- Detailed product descriptions

- Material composition

- Unit values

- Total shipment value

- Country of origin

- Vendor information

A vague description like “accessories” is almost guaranteed to trigger a review.

For a breakdown of what CBSA expects, have a look at this blog.

Packing List

Must match invoice quantities exactly.

Certificates of Origin

Required when claiming preferential duty rates.

Product Details

Some shipments may require:

- Metal purity declarations

- Gemstone disclosures

- Manufacturer statements

Why E-Commerce Jewelry Brands Face Growing Scrutiny

Many online sellers previously relied on low-value courier shipments. As enforcement increases, this strategy is becoming less reliable.

CBSA is paying closer attention to:

- Shipment frequency

- Repetitive low-value declarations

- Split shipments

- Undervalued parcels

Consolidating shipments is often safer and more predictable.

Learn how consolidation reduces risk.

Common Reasons Jewelry Shipments Are Delayed

Importers frequently encounter problems due to:

- Incorrect HS codes

- Missing origin documentation

- Undervaluation

- Poor product descriptions

- Invoice mismatches

- Duty miscalculations

Many of these issues are preventable with pre-clearance reviews.

A structured importing process can dramatically reduce errors.

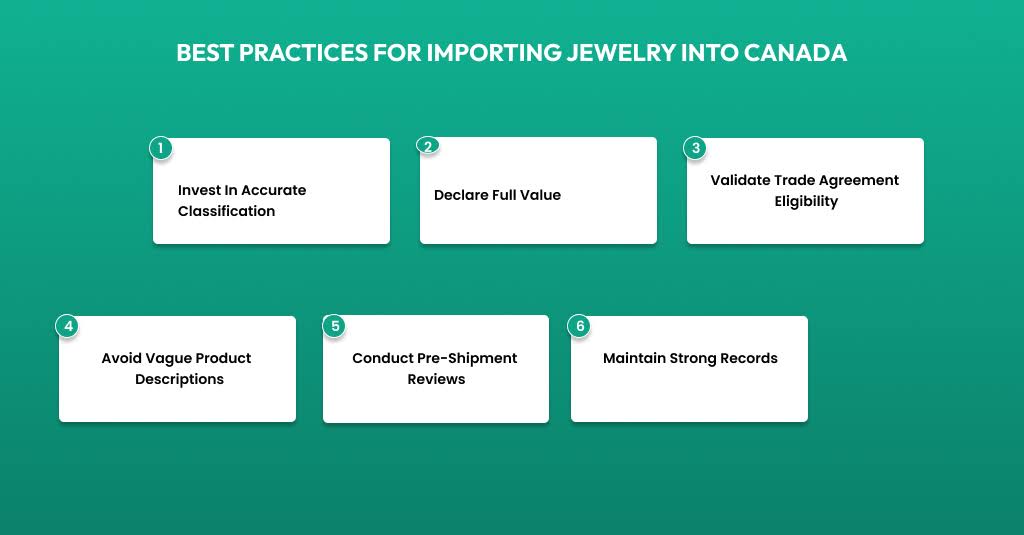

Best Practices for Importing Jewelry into Canada

1. Invest in Accurate Classification

Do not rely solely on supplier codes.

2. Declare Full Value

Transparency prevents reassessments.

3. Validate Trade Agreement Eligibility

Only claim duty relief when documentation supports it.

4. Avoid Vague Product Descriptions

Be specific about materials and construction.

5. Conduct Pre-Shipment Reviews

Fix problems before goods reach the border.

6. Maintain Strong Records

CBSA can review past imports years later.

When a Customs Broker Becomes Essential

Jewelry is not a category where importers should “learn as they go.”

A knowledgeable customs broker helps:

- Verify HS codes

- Confirm duty exposure

- Validate origin claims

- Review valuation

- Prepare compliant documentation

- Reduce inspection risk

This becomes especially important as your shipment volumes grow.

Conclusion

Importing jewelry and watches into Canada requires more than logistics planning, it demands classification precision, valuation accuracy, and strong documentation.

The good news? Most border problems are avoidable when compliance is built into your importing strategy from the beginning.

If you want your shipments to move smoothly, and your margins to stay protected, preparation is everything.

Start building a safer importing process today.

FAQs

Are jewelry imports always subject to duty?

Not always, some qualify for preferential rates depending on origin.

Do luxury watches face higher scrutiny?

Yes. High-value goods are more likely to be reviewed.

Can CBSA reassess duties after clearance?

Yes. Errors can trigger retroactive charges.

Is undervaluing jewelry illegal?

Yes, and penalties can be significant.

Do small e-commerce shipments get reviewed?

Increasingly, yes.

How long should I keep import records?

Typically six years in Canada.

Payment

Payment  My Account

My Account