Importers of all sizes have long since relied on importing from China, mainly due to lower manufacturing costs. Working with China is a cost-effective avenue for importers — and knowing this, China has also made an effort to produce products that are attractive to a Canadian market.

Whether you work with China to produce a unique item, or to resell goods they already have available, it is a viable business model for the foreseeable future.

There are certainly various key factors to consider when calculating the cost of shipping from China to Canadian soil. At a basic level, important factors include: end-to-end location, size and weight of goods, and shipping mode (sea, air, etc.).

Even though the market has been dealing with the fallout of the pandemic, operations and production in China has essentially returned to normal, however, there are still delays at the port of entry and through air travel that slow down shipping times.

Communication with the supplier is paramount. And because we cannot go visit Chinese suppliers physically right now, we need to make sure that we’re doing all that we can to build and maintain relationships – an ocean away.

As we’ve stated in a previous explainer,

“When receiving your goods, it is important to get all the facts straight before the cargo goes out. As an importer, you do not want to be hit with surprise costs and the only way to avoid this is to get as much information as you can.”

Below, we’ll cover a few elements that importers must be privy to as they move goods from China to Canada.

Goods Classification:

Thankfully, importers can all rely on the Harmonized System to classify goods internationally. In a previous article, we covered the full scope of what you might need to know about HS codes.

Recommended reading: Your Importer’s Guide to HS Codes.

HS codes are used by customs providers for a slew of reasons, mainly identifying the applicable fees, duties, and tariffs. As well as ensuring that the commercial goods are not banned or restricted from being imported into the desired destination country. (A list of prohibited goods can be found here.)

Non-Compliance:

If importers do not comply with the correct specifications based on the classification of the goods and the surrounding regulations, they may be subject to the following — costly! — consequences:

- Delays in releasing the imports

- Suspension of the privilege to import

- Fines based on the Administrative Monetary Penalty System

- Seizures of imported goods

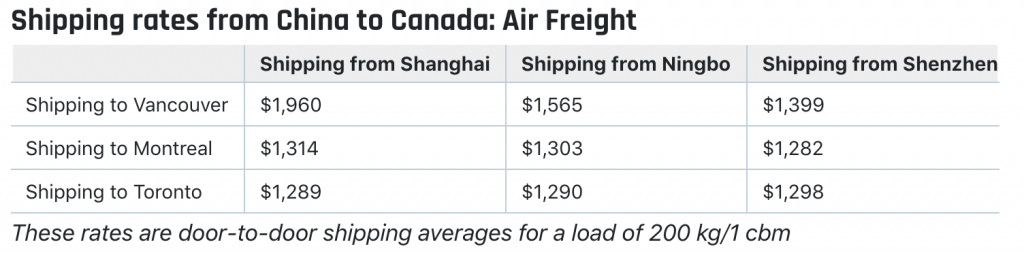

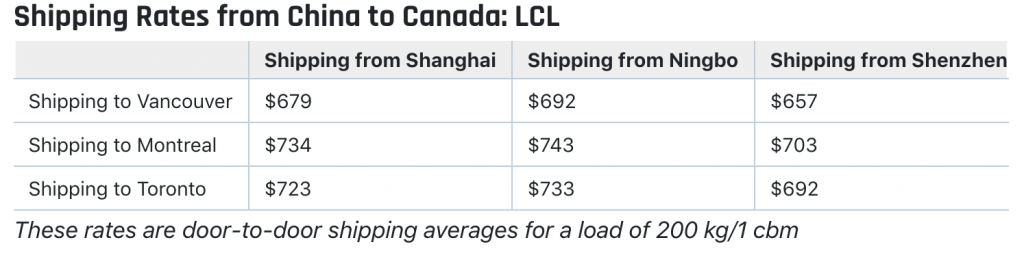

Cost of Import by Mode:

The approximate cost of shipping from various Chinese hubs to the main Canadian ports-of-entry are listed by mode below. These are standard rates as of 2021, but may be subject to change.

Source of these rates linked here.

Choosing a Customs Broker:

It is very rare that a broker is not required to efficiently import goods into Canada. A broker assists importers in preparing and submitting documentation in order to move goods into Canada — they may even file documentation on your behalf!

It is ideal to look for a broker that already specializes in the type of goods you wish to import — from perishable items, apparel and textiles, etc.

They can also help you take advantage of any trade agreements or classification issues in order to help you save money. If you’d like to begin a conversation with a customs broker, you can click here to get started!

Payment

Payment  My Account

My Account