The U.S. is Canada’s largest trading partner, and for thousands of Canadian businesses, selling to the U.S. is an essential growth strategy. However, the landscape for cross-border shipping is shifting dramatically. With the elimination of the U.S. $800 De Minimis threshold expected in 2025, Canadian exporters and e-commerce sellers must rethink how they manage low-value shipments to U.S. customers.

This change means that nearly every package entering the U.S. will require customs clearance, a sharp departure from the long-standing rule that allowed duty- and tax-free entry for shipments valued at $800 or less. Here’s what Canadian businesses need to know and how they can stay competitive in the new era of cross-border trade.

What Is the De Minimis Threshold, and Why Is It Changing?

The De Minimis threshold is the dollar amount below which imported goods can enter a country without paying duties or taxes. For years, U.S. importers and Canadian sellers enjoyed the $800 exemption, which simplified logistics for low-value e-commerce shipments.

Now, with concerns about revenue loss and the growth of high-volume, low-value imports, U.S. lawmakers are moving to eliminate the $800 threshold entirely. Once in effect, every shipment to the U.S., regardless of value, will require a formal customs entry.

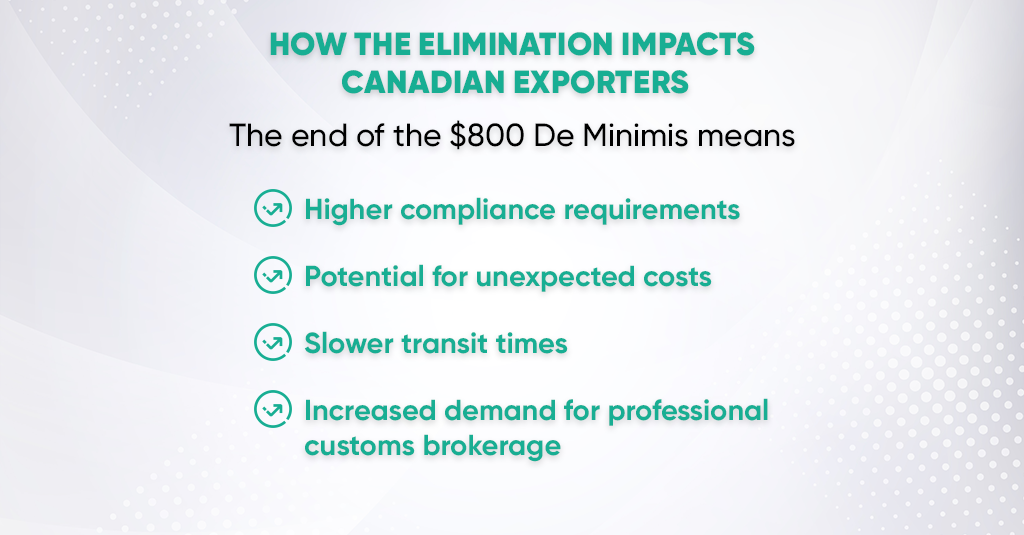

How the Elimination Impacts Canadian Exporters

The end of the $800 De Minimis threshold creates higher compliance requirements, potential costs, and increased demand for brokers.

The end of the $800 De Minimis means:

- Higher compliance requirements: All goods will need proper classification, valuation, and customs paperwork.

- Potential for unexpected costs: Without accurate brokerage, duties and taxes may be miscalculated, and carriers could apply high service fees

- Slower transit times: Shipments may face delays if clearance procedures aren’t handled efficiently.

- Increased demand for professional customs brokerage: Businesses can no longer rely solely on courier companies like FedEx or UPS to manage low-value shipments.

Example: A boutique shipping $500 worth of handmade jewelry to U.S. customers will now need to file customs paperwork and pay duties, even though such items previously cleared duty-free.

For guidance on ensuring your goods meet U.S. customs standards, check out our post on Canada Duty Remission and Relief Programs.

Strategies to Stay Competitive

Canadian exporters can stay competitive by adopting smart shipping and pricing strategies after the De Minimis change.

1. Partner With a Customs Broker

Working with a professional customs broker like Clearit helps you streamline clearance for high- and low-value shipments alike. Brokers ensure correct tariff classification, duty calculation, and paperwork submission, minimizing delays and surprise costs.

Example: A small skincare brand selling $300 orders to U.S. buyers can use a broker to avoid carrier surcharges and misclassified duties.

2. Reassess Pricing and Shipping Policies

Always factor in duties, taxes, and brokerage fees when setting prices for U.S. customers. Offering transparent shipping costs upfront helps build trust and avoids cart abandonment.

3. Consolidate Shipments

Where possible, consolidate multiple orders into fewer, higher-value shipments to cut down on paperwork and reduce per-unit clearance costs

Example: A home decor shop might bundle several $100 orders into a single $600 shipment to reduce per-package clearance fees.

4. Automate Documentation

Leverage digital tools to pre-fill shipping data, commercial invoices, and product classifications, reducing human error and speeding up clearance.

Learn how digital customs tools can simplify cross-border compliance.

Why Carriers Alone Aren’t Enough

While major couriers handle customs clearance for many shipments, they aren’t set up for the volume and complexity of post-De Minimis trade. Misbilled duties, overcharges, or returned shipments (such as a $600 parcel that incurred $2,000 in fees before being returned to the sender) are already warning signs.

Using a specialized brokerage service like Clearit ensures a cost-effective and accurate process that protects your margins and reputation.

Need help understanding product-specific requirements? Explore our guides for importing e-bike kits into Canada or importing beauty products to see how targeted compliance advice works.

FAQs About De Minimis Elimination for Canadian Sellers

1. When will the $800 De Minimis threshold be eliminated?

Legislation is expected to take effect in 2025, though final implementation dates may vary depending on U.S. government decisions.

2. Will all shipments require customs clearance after the change?

Yes. Every shipment entering the U.S., regardless of value, will require customs documentation and may be subject to duties and taxes.

3. How will this affect returns and exchanges?

Returned goods may also require clearance when re-entering the U.S. or coming back to Canada. Work with a broker to set up a smooth returns process.

4. What if I sell primarily to U.S. consumers via marketplaces?

Platforms like Amazon and Etsy may update their seller policies to reflect new customs requirements. However, ultimate compliance responsibility remains with you as the seller.

5. How can Clearit help?

Clearit provides end-to-end customs brokerage services for Canadian businesses shipping to the U.S. We help you classify products, prepare paperwork, and avoid unnecessary costs or delays.

The Bottom Line

The elimination of the U.S. De Minimis threshold will reshape cross-border selling for Canadian businesses. By planning ahead, with accurate compliance, efficient shipping practices, and the right customs support, you can turn regulatory change into a growth opportunity.

Ready to simplify cross-border shipping? Visit Clearit Canada today and learn how our platform can help your business thrive in the new post-De Minimis environment.

Payment

Payment  My Account

My Account