In 2025, Canadian apparel exporters face a stricter trade environment. Shipping garments into the United States now requires stronger documentation, tighter verification, and a deeper understanding of duty-relief programs. Yet many exporters, cut-and-sew facilities, fashion brands, and textile manufacturers still assume that producing apparel in Canada automatically qualifies their products for CUSMA (USMCA) duty-free treatment.

Unfortunately, the rules for textiles and apparel are far more complex.

For many clothing categories, cutting and sewing in Canada is not enough. That’s where Tariff Preference Levels (TPL) become essential — a quota-based program that allows Canadian apparel exporters to ship goods duty-free to the United States even when the fabric itself is imported.

This guide explains the difference between CUSMA and TPL, how each program impacts cross-border apparel shipments, and what Canadian exporters need to do to avoid unnecessary duties, penalties, or clearance delays.

Why are the CUSMA Apparel Rules so Strict?

CUSMA’s rules of origin are among the strictest in any trade agreement, especially for textiles. Clothing must meet specific “originating material” requirements before qualifying for duty-free access.

Here’s why most brands don’t qualify:

1. Yarn-Forward and Fabric-Forward Rules

For many garment categories, the fibres, yarns, or fabrics must be produced in North America for the final garment to qualify.

If your textiles come from:

- China

- India

- Pakistan

- Vietnam

- Turkey

2. Cutting & Sewing in Canada Isn’t Enough

Many brands mistakenly assume the location of assembly determines origin. Under CUSMA, material origin determines qualification.

3. Missing Supplier Documentation Causes Failed Claims

CBP requires evidence that yarns and fabrics are North American. Most failed claims occur because exporters cannot provide:

- Yarn/fabric origin statements

- Complete bills of materials

- Correct HTS/HS classifications

- Updated supplier databases

4. Consequences of Incorrect CUSMA Claims

Issuing improper CUSMA declarations can result in:

- Surprise duty bills

- CBP reassessments

- Penalties

- Export audit flags

- Shipment delays or refusals at the border

This is why understanding TPL is so important, because many apparel exporters do qualify for duty relief, just not under CUSMA.

When Your Apparel Doesn’t Qualify for CUSMA: The Role of TPL

Tariff Preference Levels (TPL) provide a practical duty-relief option for exporters that cut and sew apparel in Canada using imported fabric.

What is TPL?

TPL is a quota-based program that allows a specified annual quantity of apparel to enter the U.S. duty-free or at reduced duty rates, despite using imported fabrics.

Why TPL Works for Apparel:

- Imported textiles are permitted

- Duty-free access is still available

- Only an export permit is required

- No complex origin tracing or supplier documentation

For most Canadian apparel exporters, TPL is the correct duty-relief program — not CUSMA.

How TPL Works for Apparel Exporters

1. TPL Categories

TPL applies to:

- Knit apparel

- Woven apparel

- Certain home textiles

Each has its own quota limits.

2. Quota-Based System

Quota is allocated on a first-come, first-served basis. Once the quota is filled, no more TPL benefits are available for that calendar year.

3. Export Permit Required

You must obtain a TPL export permit before the shipment crosses the border.

Without it, CBP will apply full MFN duty rates.

4. What Happens If the Quota Is Used Up?

You will pay full duties — often 16–32% for apparel, depending on classification.

5. Common Mistakes

- Applying for permits too late in the year

- Assuming cutting/sewing automatically allows CUSMA

- Wrong HTS classification

- Invoice descriptions not matching TPL categories

- Shipping before receiving the export permit

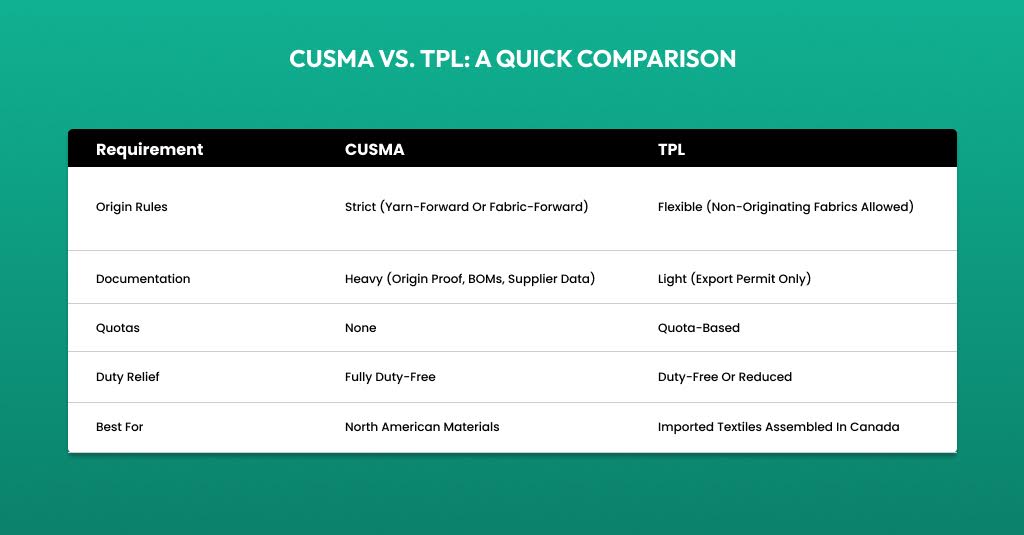

CUSMA vs. TPL: A Quick Comparison

Quick comparison chart showing how CUSMA and TPL differ in origin rules, documentation, quotas, and duty relief for Canadian apparel manufacturers.

| Requirement | CUSMA | TPL |

|---|---|---|

| Origin Rules | Strict (yarn-forward or fabric-forward) | Flexible (non-originating fabrics allowed) |

| Documentation | Heavy (origin proof, BOMs, supplier data) | Light (export permit only) |

| Quotas | None | Quota-based |

| Duty Relief | Fully duty-free | Duty-free or reduced |

| Best For | North American materials | Imported textiles assembled in Canada |

Most Canadian apparel exporters fall into the TPL category even when they’ve been using CUSMA incorrectly for years.

Documentation Checklist for Apparel Exporters

If Claiming CUSMA

- Supplier origin statements

- Yarn/fabric production details

- Bills of materials

- Cutting/sewing records

- Properly completed CUSMA origin certification

If Claiming TPL

- TPL export permit

- Accurate HTS codes

- Clear product descriptions

- Invoice matching TPL category

See also: How to Prepare for U.S. Customs Audits as a Canadian Business

Planning: How Apparel Brands Should Approach Annual TPL Strategy

To avoid duty shock, exporters should:

1. Forecast Annual Volume

Predict how much knit, woven, and textile inventory will ship into the U.S.

2. Apply for TPL Early

Quotas can fill fast, especially for knit apparel.

3. Standardize Documentation

Ensure all invoices match TPL descriptions to prevent border delays.

4. Consolidate Shipments Strategically

Sending multiple small shipments is inefficient post-De Minimis.

Helpful resource: How Canadian E-Commerce Brands Can Lower Costs by Consolidating Shipments

5. Consider Long-Term Compliance Planning

As enforcement increases, having a structured process is essential.

For step-by-step support: Our Quick Start Guide to Stress-Free Importing

Conclusion

For Canadian apparel exporters, CUSMA is not the only option — and in many cases, it isn’t the correct one. Understanding the difference between CUSMA and TPL can dramatically reduce duty exposure, prevent clearance delays, and protect margins in a stricter enforcement environment.

Your ability to ship smoothly into the U.S. depends on accurate documentation, proper classification, and knowing which program your products genuinely qualify for.

Unsure whether your apparel qualifies for CUSMA or should use TPL? Preparing a complete documentation package early is the key to avoiding duty costs and preventing border delays.

FAQs

Do I need both CUSMA and TPL for the same shipment?

No. They are mutually exclusive.

What happens if the TPL quota is full?

Your shipment will be subject to full MFN duty rates.

Can I claim CUSMA without full fabric origin documentation?

No. CBP will reject the claim.

How long does it take to get a TPL permit?

Processing is usually fast, but only if documents are prepared correctly.

Does TPL apply to hats, gloves, or scarves?

Some accessories qualify. Classification determines eligibility.

Payment

Payment  My Account

My Account