Most importers don’t get into trouble with CBSA because they meant to do something wrong.

They get into trouble because something was classified incorrectly, valued incorrectly, or declared incorrectly, and it wasn’t fixed fast enough.

In 2025, with stronger enforcement, deeper data analytics, and increased post-import verification through programs like CARM, CBSA is finding more errors than ever before. When they do, you’re faced with a critical question:

Do you wait for CBSA to assess penalties, or do you take control of the situation proactively?

Two tools determine the outcome: Prior Disclosure and Petitions for Mitigation. Before we break these down, if you’re new to how penalties and assessments work in Canada, read our detailed guide on how CBSA AMPs and penalties arise from importer errors.

Why CBSA Cares About Import Errors

CBSA’s job is to ensure that every commercial import is:

- Correctly classified

• Properly valued

• Declared with the right country of origin

• Assessed for the right duties and taxes

Even small errors affect not just revenue, but trade statistics, safety enforcement, and trade policy.

That’s why CBSA runs:

- Post-release verifications

• Compliance audits

• Risk-based targeting programs

• Ongoing data analysis under CARM (the Canada Border Services Agency’s modern compliance transformation)

And when errors are found, CBSA expects importers to correct them, not ignore them.

If you’re unsure whether your imports are being reported as commercial vs. casual (which affects compliance obligations and penalties), check out our comparison here.

What Happens When CBSA Finds a Problem

CBSA may identify errors through:

- An audit or post-release verification

• A B2 adjustment review

• Courier or broker data

• Pattern analysis across shipments

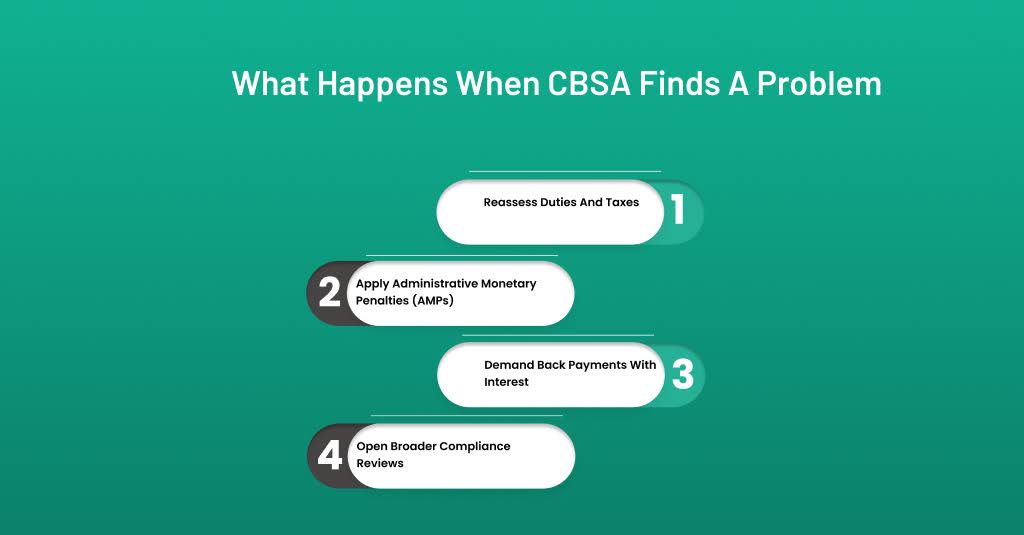

Once an issue is detected, CBSA can:

CBSA may reassess duties, apply AMPs, charge interest, or expand compliance reviews when import issues are identified.

- Reassess duties and taxes

• Apply Administrative Monetary Penalties (AMPs)

• Demand back payments with interest

• Open broader compliance reviews

At that point, your options narrow.

That’s why acting early matters.

What Is a Prior Disclosure?

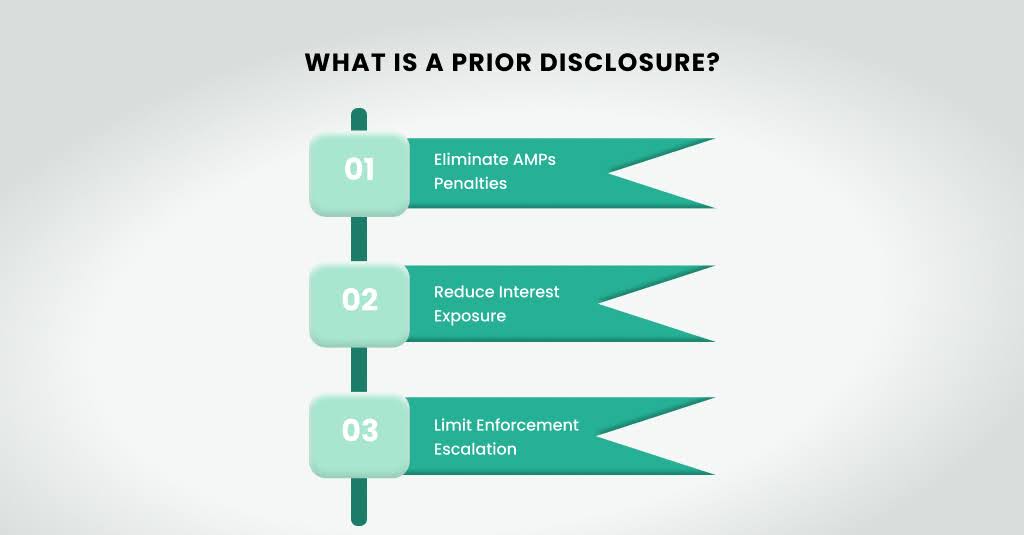

A Prior Disclosure allows an importer to voluntarily disclose an error to CBSA before the agency formally identifies it.

It applies when an importer identifies errors such as:

- Incorrect HS codes

• Wrong country of origin

• Undervalued goods

• Missing duties or taxes

By coming forward first, you demonstrate good faith and compliance intent.

When accepted, a Prior Disclosure can:

- Eliminate AMPs penalties

• Reduce interest exposure

• Limit enforcement escalation

CBSA still collects the duties and taxes owed, but the financial and legal consequences are far less severe.

When a Prior Disclosure Is No Longer Available

A prior disclosure allows importers to correct errors voluntarily and reduce penalties under CBSA compliance programs.

Once CBSA reaches out with a verification request, compliance letter, or audit notice, Prior Disclosure is no longer on the table.

That’s when the second tool, Petitions for Mitigation, becomes critical.

What Is a Petition for Mitigation?

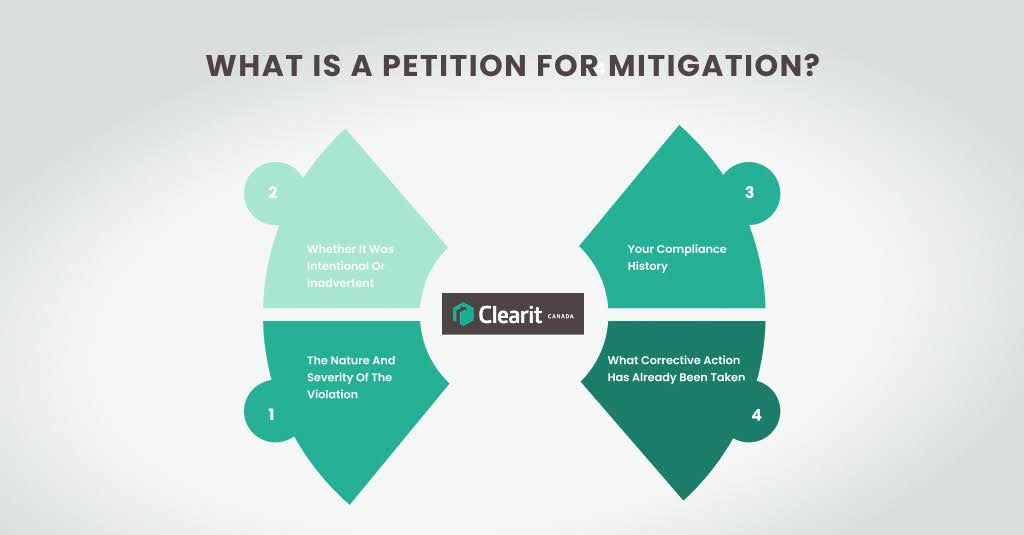

A Petition for Mitigation is used after CBSA has issued penalties.

It allows you to request:

- Reduction of AMPs penalties

• Cancellation in certain circumstances

• Relief based on compliance history or corrective actions

Unlike a Prior Disclosure, this is not voluntary; it is a formal response to an enforcement action.

CBSA reviews multiple factors when assessing petitions for mitigation related to penalties or compliance violations.

When considering mitigation, CBSA looks at:

- The nature and severity of the violation

• Whether it was intentional or inadvertent

• Your compliance history

• What corrective action has already been taken

Mitigation doesn’t erase errors, but it can significantly reduce financial damage when used appropriately.

Prior Disclosure vs. Petition for Mitigation — At a Glance

| Situation | Best Tool |

|---|---|

| You found an error before CBSA | Prior Disclosure |

| CBSA already assessed penalties | Petition for Mitigation |

| Your goal is to avoid AMPs | Prior Disclosure |

| Your goal is to reduce already assessed penalties | Petition for Mitigation |

Why Many Importers Miss Their Best Opportunity

The most common importer mistake is waiting too long.

They:

- Hope CBSA won’t notice

• Assume the broker will fix it

• Treat small errors as negligible

But CBSA’s systems are sophisticated. Small mistakes, repeated over time, turn into patterns, and patterns trigger enforcement.

Once CBSA opens a compliance file, the opportunity for voluntary correction disappears.

If you’re feeling stuck before importing, or just need stress-free clarity on processes, check out our quick start guide to stress-free importing.

Conclusion

When CBSA identifies an import error, your response determines the outcome.

If you act early, Prior Disclosure gives you control. If you wait, Petitions for Mitigation help manage the consequences.

Compliance isn’t about perfection. It’s about clarity, accountability, and timely action. When importers understand their options, they turn compliance into a competitive advantage, not a liability.

FAQs

Can I still file a Prior Disclosure after CBSA contacts me?

No. Once CBSA starts an audit or compliance review, Prior Disclosure is no longer available.

Do I still have to pay duties if I disclose?

Yes. Duties and taxes must always be paid, but penalties may be waived with a Prior Disclosure.

Can CBSA reject a Prior Disclosure?

Yes, if they determine the issue was already under review or insufficiently documented.

Does mitigation guarantee penalty relief?

No, but it often reduces penalties significantly when presented appropriately.

How far back can CBSA reassess errors?

For most commercial errors, CBSA can go back up to four years, which makes early action even more important.

Payment

Payment  My Account

My Account