For many Canadian importers, having a shipment flagged by the Canada Border Services Agency (CBSA) can feel like hitting a wall—unexpected delays, rising storage fees, and anxious customers waiting for updates.

But CBSA holds aren’t random punishments—they’re signals that something in your paperwork, risk profile, or shipment triggered additional scrutiny.

In 2025, as cross-border enforcement tightens and documentation standards continue to rise, understanding the types of CBSA holds is no longer optional. It’s essential to keep your supply chain moving.

This guide breaks down the four most common CBSA holds, why they happen, how long they last, and what you can do to prevent them.

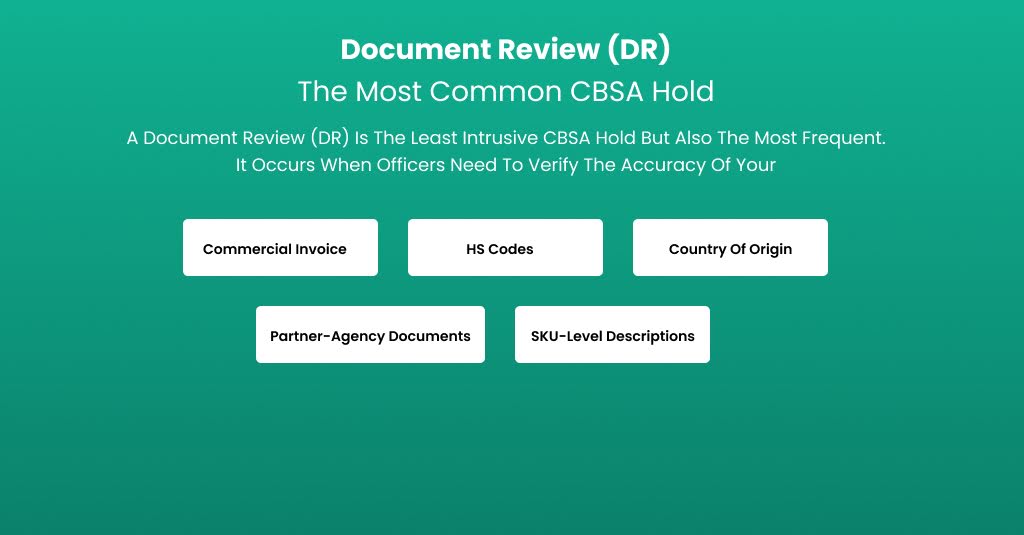

Document Review (DR): The Most Common CBSA Hold

The CBSA Document Review (DR) hold focuses on validating commercial invoices, HS codes, country of origin, partner-agency documents, and SKU-level product details to ensure accurate customs compliance.

A Document Review (DR) is the least intrusive CBSA hold but also the most frequent.

It occurs when officers need to verify the accuracy of your:

- Commercial invoice

- HS codes

- Country of origin

- Valuation

- Partner-agency documents

- SKU-level descriptions

Documentation issues are the #1 cause of delays, especially among small businesses and e-commerce exporters expanding into the U.S.

For comparison, Canadian exporters shipping southbound also face stricter document checks under U.S. CBP, a trend explained in detail in our guide on preparing for U.S. customs audits.

Why DR holds happen:

- Vague or generic product descriptions

- Inconsistent HS codes

- Suspected undervaluation

- Incorrect country of origin

- Poor supplier invoice formatting

- Incomplete U.S.-ready invoice data (materials, weights, Incoterms, etc.)

A solid documentation process, like the one outlined in Clearit’s U.S.-ready commercial invoice guide, helps prevent DR holds.

Typical delay:

A few hours to a few days, depending on port workload and document quality.

VACIS / X-Ray Scans: Risk-Based Cargo Imaging

VACIS (Vehicle and Cargo Inspection System) is a non-intrusive X-ray scan that allows CBSA to inspect cargo without unloading it.

Triggers for a VACIS scan:

- Weight discrepancies

- Anomalies identified during document review

- Conflicting cargo descriptions

- Supplier compliance risk

- Random targeting from CBSA risk models

VACIS itself is quick, usually minutes, but delays occur when the cargo must wait in the queue or when officers need to compare imaging results with invoice data.

If your shipments move between Canada and the U.S., VACIS-style inspections are also part of U.S. compliance workflows. Clearit’s cross-border shipment consolidation guide explains how importers can reduce risk.

Full Physical Examination (EXAM): The Most Disruptive Hold

A full physical CBSA exam is the most disruptive and most expensive type of hold. Officers may unload, unpack, test, verify, and then repack the cargo—often at a third-party warehouse—resulting in:

- Repacking charges

- Demurrage

- Storage

- Warehouse handling fees

- Extended delays

What triggers an exam:

- Suspicious VACIS results

- Inconsistent or incorrect documentation

- High-risk product categories (electronics, food, cosmetics, apparel)

- Possible misclassification or undervaluation

- Concerns about PGA compliance (CFIA, NRCan, Health Canada)

- Past compliance issues with the importer or supplier

Typical delay:

Several days to weeks, depending on port, staffing, and exam complexity.

Good pre-clearance workflows, like those recommended in Clearit’s stress-free importing guide to significantly reduce exam risks.

Random Inspections: Compliance Profiling in Action

CBSA “random” inspections aren’t truly random. They are influenced by:

- Importer risk profiles

- Supplier history

- Tariff classification patterns

- Origin country risk

- Growth in shipment volume

- Industry-wide targeting trends

Why do they happen?

- Validating an importer’s classification accuracy

- Reviewing compliance for rapidly growing e-commerce sellers

- Verifying documentation consistency

- Checking industries with high rates of undervaluation or mislabeling

How CBSA Holds Affects Canadian Businesses

When a shipment is held, businesses experience:

- Delayed deliveries

- Increased warehouse & storage charges

- Rejected loads

- Courier/trucking disruptions

- Inventory shortages

- Frustrated end customers

Higher audit exposure

For exporters sending goods to the U.S., CBSA often mirrors the bottlenecks caused by the U.S. CBP’s increasing documentation scrutiny. Importers can avoid many issues by reducing classification errors, a strategy explained in our guide on avoiding double duty.

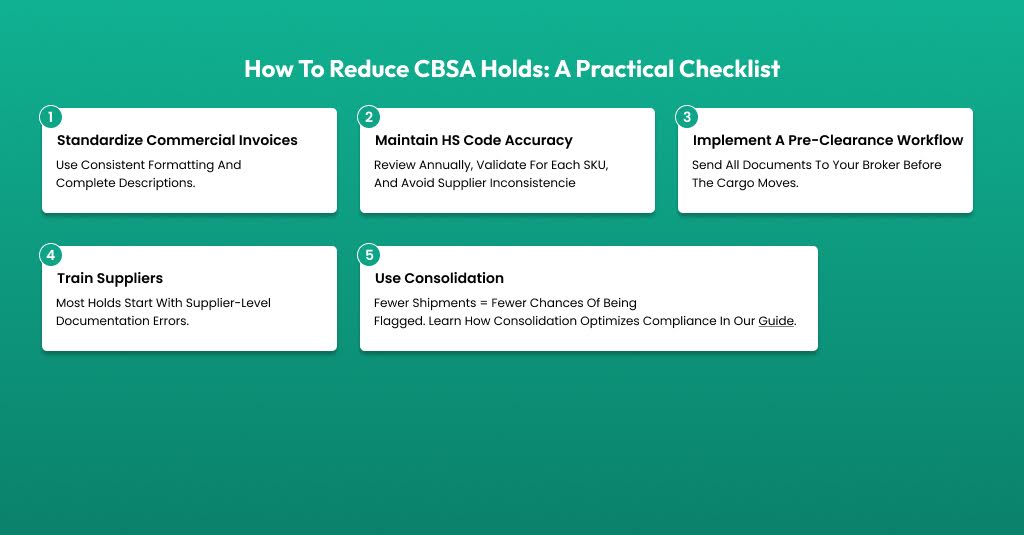

How to Reduce CBSA Holds: A Practical Checklist

Standardize Commercial Invoices

Use consistent formatting and complete descriptions.

Maintain HS Code Accuracy

Review annually, validate for each SKU, and avoid supplier inconsistencies.

Implement a Pre-Clearance Workflow

Send all documents to your broker before the cargo moves.

Train Suppliers

Most holds start with supplier-level documentation errors.

Use Consolidation

Fewer shipments = fewer chances of being flagged. Learn how consolidation optimizes compliance in our guide.

Conclusion

The CBSA’s enforcement model has evolved. Holds and inspections are more common, more data-driven, and more costly when documentation isn’t perfect. Importers who invest in accurate, consistent paperwork and supplier-level compliance now move faster, face fewer delays, and avoid unnecessary penalties.

Your paperwork is now your strongest border strategy, or your biggest bottleneck.

Clearit Canada helps importers eliminate guesswork at the border with:

- Pre-clearance documentation checks

- HS code validation

- Supplier invoice standardization

- Cross-border compliance workflows

- Real-time support for Canadian businesses

Don’t wait for the next CBSA hold to learn your supply chain’s weak spots. Get your documentation audit-ready before the truck moves. Start your next shipment with Clearit Canada today.

FAQs

1. Why was my shipment selected for CBSA review?

Most often due to documentation inconsistencies, misclassification, risk profiling, or random compliance checks.

2. How long do CBSA holds usually last?

Document reviews may take hours; full exams can take days or weeks, depending on volume and complexity.

3. Can my carrier fix documentation issues for me?

No. Carriers cannot modify invoices, HS codes, or origin data. Only importers or customs brokers can correct errors.

4. Do small businesses face the same scrutiny as large importers?

Yes, CBSA’s data-driven risk systems target inconsistencies, not company size.

5. How do I know if my documentation is “CBSA-ready”?

Your commercial invoice should include full SKU descriptions, HS codes, origin, Incoterms, and values, identical to U.S.-ready invoices explained here:

6. Can consolidation reduce CBSA holds?

Yes. Fewer, larger shipments with consistent paperwork reduce risk significantly.

Payment

Payment  My Account

My Account