Most importers assume CBSA only reviews shipments when something goes wrong.

In reality, CBSA doesn’t wait for mistakes to surface. Each year, it proactively selects specific products, industries, and compliance areas for targeted review. These are known as Trade Verification Priorities, and if your imports fall within them, scrutiny is not optional.

With stronger enforcement, deeper data analytics, and the rollout of CARM, trade verification is no longer a background risk. It’s an active part of importing into Canada.

This guide explains what CBSA’s trade verification priorities are, how they work, and what Canadian importers should do to prepare.

What Are CBSA Trade Verification Priorities?

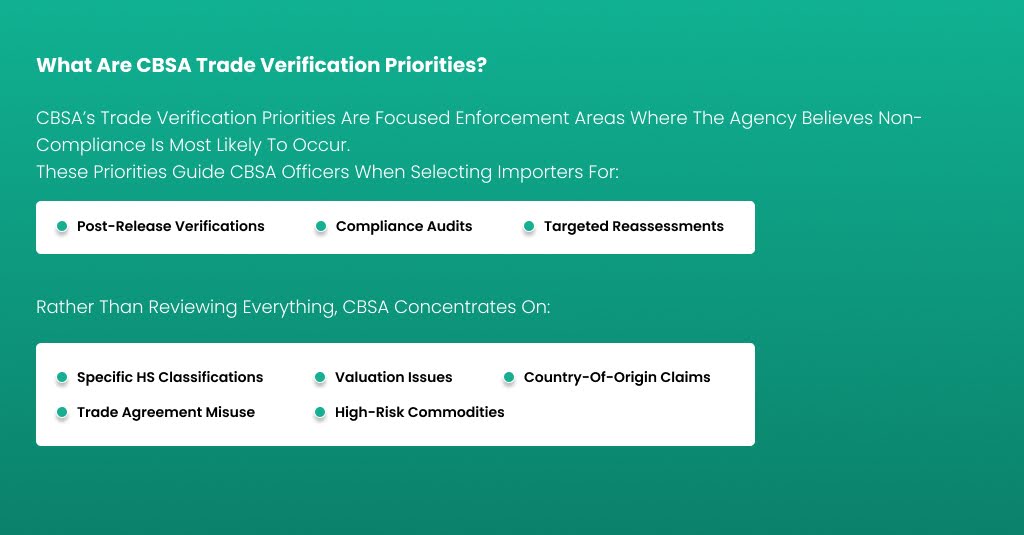

CBSA’s Trade Verification Priorities are focused enforcement areas where the agency believes non-compliance is most likely to occur.

These priorities guide CBSA officers when selecting importers for:

- Post-release verifications

• Compliance audits

• Targeted reassessments

Rather than reviewing everything, CBSA concentrates on:

- Specific HS classifications

• Valuation issues

• Country-of-origin claims

• Trade agreement misuse

• High-risk commodities

If your imports align with a priority category, the likelihood of review increases significantly, even if you’ve never had issues before.

Why CBSA Uses Trade Verification Priorities

CBSA’s mandate isn’t just revenue collection.

It also includes:

- Trade policy enforcement

• Safety and regulatory compliance

• Fair competition

• Data accuracy

By focusing on priority areas, CBSA can identify systemic issues faster, especially where errors repeat across multiple importers.

This approach is closely tied to Administrative Monetary Penalties (AMPs). Many penalties don’t arise from one-off mistakes, but from patterns discovered during trade verifications. If you’re not familiar with how these penalties arise, Clearit breaks this down in detail here.

Common Areas CBSA Targets in Trade Verifications

While priorities change over time, CBSA trade verifications typically focus on a few recurring compliance risks.

Classification Errors

Incorrect HS codes remain one of the most common issues CBSA finds — especially where similar products are classified inconsistently.

Valuation Issues

Undervaluation, missing assists, and incorrect transaction values frequently trigger reassessments.

Country of Origin

Improper origin declarations can affect duty rates and trade agreement eligibility.

Trade Agreement Claims

Misuse of CUSMA and other agreements is a high-risk area, particularly when documentation is weak.

Commercial vs. Casual Importing

CBSA closely watches importers who declare shipments as casual when they are clearly commercial in nature. If this distinction is unclear, see Clearit’s breakdown here.

How Trade Verifications Actually Happen

A trade verification doesn’t usually start with a fine.

It often begins with:

- A verification letter

• A request for documents

• A defined review period

CBSA may ask for:

- Commercial invoices

• Classification rationale

• Origin certificates

• Valuation support

• Accounting records

If discrepancies are found, CBSA can:

- Reassess duties and taxes

• Issue AMPs

• Expand the scope of the review

• Look back up to four years

The process is structured, but the outcomes can be costly if you’re unprepared.

Why CARM Has Increased Verification Risk

With the implementation of CARM, CBSA now has greater visibility into importer behavior.

CARM allows CBSA to:

- Link imports across accounts

• Identify patterns faster

• Track importer responsibility more clearly

• Enforce payment and compliance rules more consistently

If you’re still adjusting to how CARM affects your obligations, Clearit’s overview explains what importers need to know.

Documentation Is Where Most Verifications Are Won or Lost

In many trade verifications, the issue isn’t that goods were intentionally misdeclared — it’s that documentation doesn’t support the declaration.

Weak or incomplete invoices are a common trigger for reassessment. If your imports involve the U.S., Clearit’s guide to U.S.-ready commercial invoices for Canadian importers is a useful reference.

What Importers Should Do If They’re Selected for Verification

If CBSA contacts you, how you respond matters.

Importers should:

- Review the scope carefully

• Gather complete documentation

• Validate classifications and values

• Correct errors promptly

• Avoid assumptions or incomplete responses

Ignoring a verification or responding casually almost always leads to penalties.

Preparing for Trade Verification Before It Happens

The best way to manage CBSA trade verification is to assume it will happen.

That means:

- Reviewing high-risk products

• Ensuring consistent classifications

• Confirming origin documentation

• Monitoring repeated shipment patterns

• Understanding importer responsibilities

If you’re still building confidence in your import process, Clearit’s quick start guide to stress-free importing offers a solid foundation.

Conclusion

CBSA’s Trade Verification Priorities are not warnings. They are signals.

They tell importers where CBSA is looking, and what it expects to find.

Importers who understand these priorities can correct issues early, avoid penalties, and maintain predictable operations. Those who ignore them often learn the hard way.

Trade verification isn’t random. It’s targeted. And preparation is the difference between disruption and control.

FAQs

Are trade verifications random?

No. They are risk-based and aligned with CBSA priorities.

Can CBSA reassess past imports?

Yes, typically up to four years.

Does a verification always result in penalties?

No, but unresolved errors often do.

Can I fix errors during a verification?

Sometimes, but early correction is always better.

How do I know if my products are high-risk?

By reviewing classification, valuation, and origin consistency across shipments.

Payment

Payment  My Account

My Account