The Courier Low Value Shipment (CLVS) Program was designed to speed up border clearance for low-risk, low-value imports. But in recent years, it has become one of the most misunderstood and misused customs programs in Canada.

For businesses, especially e-commerce sellers, CLVS often appears to be an “easy button.” Faster clearance. Less paperwork. Lower upfront friction.

The problem? CLVS is not a business-scaling strategy, and CBSA is increasingly cracking down on companies that rely on it incorrectly.

This article explains how the CLVS program works, who it’s intended for, why businesses misuse it, and the risks importers face in 2025 and beyond.

What Is the CLVS Program?

The Courier Low Value Shipment (CLVS) Program allows approved courier companies to clear low-value shipments through a simplified customs process.

Key CLVS Criteria

- Goods must be shipped by an approved courier

- Shipment value must be below the CLVS threshold

- Goods must be non-restricted and low risk

- Clearance is handled using summary-level data, not full commercial entry data

CLVS was created to help CBSA:

- Move small shipments quickly

- Reduce administrative burden

- Focus enforcement on higher-risk imports

It was never designed as a long-term import model for businesses.

What CLVS Is Meant For

CLVS works well in very specific situations.

Appropriate Uses of CLVS

- Personal online shopping

- Occasional, low-value purchases

- One-off sample shipments

- Casual importers (non-commercial use)

In these cases, the simplified process makes sense.

Where Businesses Go Wrong with CLVS

Many businesses, especially small e-commerce sellers, use CLVS far beyond its intended scope.

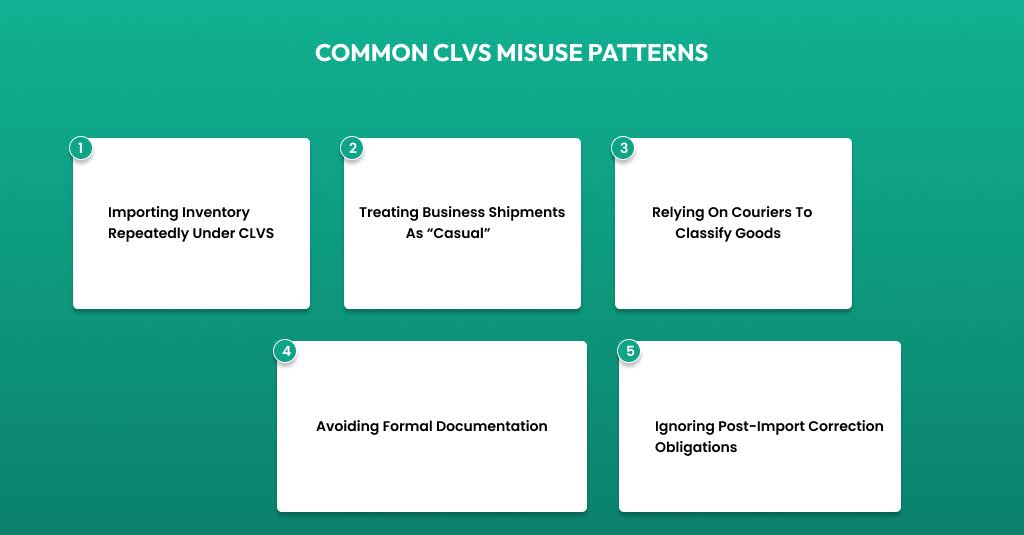

Common CLVS Misuse Patterns

“These CLVS misuse patterns often trigger CBSA reassessments, audits, and penalties as shipment volume increases.”

- Importing inventory repeatedly under CLVS

- Treating business shipments as “casual”

- Relying on couriers to classify goods

- Avoiding formal documentation

- Ignoring post-import correction obligations

This often starts unintentionally, then escalates quickly as shipment volume increases.

CBSA does not look at shipment value alone; they look at patterns, intent, and frequency.

Why CBSA Is Cracking Down on Courier Low Value Program (CLVS) Abuse

CBSA enforcement is increasingly retrospective, meaning patterns may be reviewed months or years after goods are delivered. In 2025, CLVS misuse is firmly on CBSA’s radar.

Key Enforcement Drivers

- Increased e-commerce volumes

- Data analytics flagging repeat shipments

- Courier data sharing with CBSA

- Higher alignment with U.S. enforcement trends

- Growing use of audits and verifications

This mirrors the broader rise in documentation scrutiny explained here. What once passed quietly is now flagged quickly.

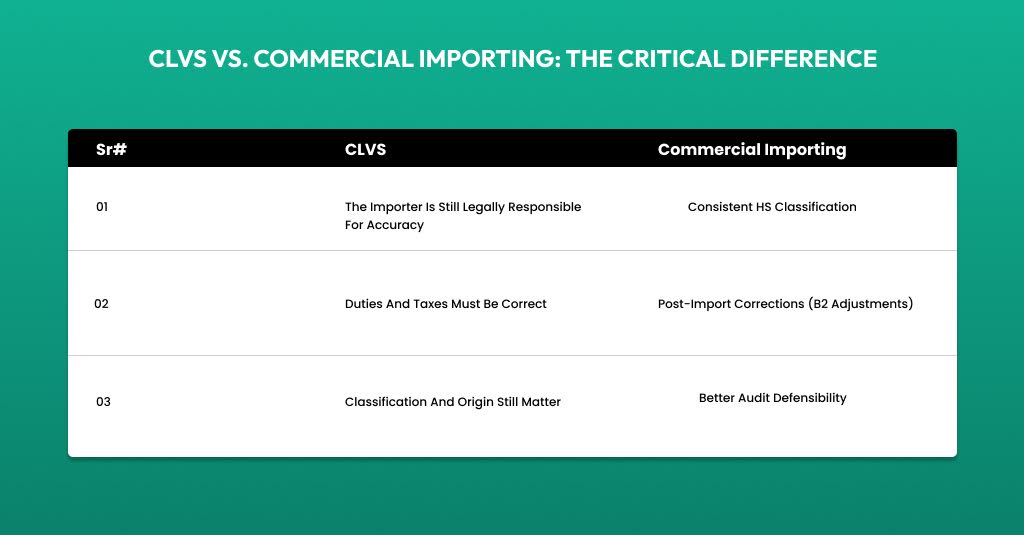

CLVS vs. Commercial Importing: The Critical Difference

“Unlike CLVS, commercial importing gives businesses documentation control, correction options, and long-term compliance protection.”

CLVS does not eliminate importer responsibility.

Even under CLVS:

- The importer is still legally responsible for accuracy

- Duties and taxes must be correct

- Classification and origin still matter

However, CLVS provides less visibility and less control, which creates risk for businesses. Commercial importing, while more structured, allows:

- Consistent HS classification

- Post-import corrections (B2 adjustments)

- Better audit defensibility

If you’re unfamiliar with post-import corrections, this guide explains them clearly:

Why Couriers Can’t Be Your Compliance Strategy

One of the biggest misconceptions is that couriers “handle customs.”

Couriers:

- Transmit shipment data

- Facilitate release

- Do not manage compliance strategy

They do not:

- Validate HS codes

- Verify origin claims

- Protect you from audits

- Fix systemic documentation errors

When problems arise, CBSA looks to the importer, not the courier. This same issue is driving increased scrutiny in cross-border movements overall.

Red Flags That Trigger CBSA Attention Under CLVS

CBSA analytics are designed to catch patterns, including:

- Frequent CLVS shipments with similar goods

- Identical SKUs across multiple entries

- Shipments addressed to warehouses or fulfillment centres

- Business names or platforms in consignee details

- Inconsistent values or descriptions

- Repeated “samples” or “accessories.”

Once flagged, CBSA may:

- Reclassify shipments as commercial

- Reassess duties and taxes

- Apply AMPS penalties

- Expand reviews across prior shipments

Why CLVS Breaks Down as You Scale

CLVS lacks:

- Detailed documentation

- Audit trail

- Correction mechanisms

- Consistency

As volume increases, these gaps turn into real costs:

- Delays

- Storage fees

- Retroactive reassessments

- Customer delivery failures

This is why scaling importers are encouraged to move toward structured importing, as outlined in our quick start guide.

When Businesses Should Move Away from CLVS

CLVS is no longer appropriate when:

- You import inventory regularly

- You sell goods commercially

- You ship to customers or 3PLs

- You plan to scale volume

- You need predictable landed costs

At that point, formal commercial importing is not optional; it’s necessary.

Better Alternatives to CLVS for Businesses

Instead of relying on CLVS, growing businesses should consider:

- Formal commercial entries

- Consolidated shipments

- Proper invoice standardization

- Broker-led compliance workflows

These strategies provide:

- Lower long-term risk

- Better cost visibility

- Stronger audit protection

Conclusion

The CLVS program was designed for speed, not scale.

For businesses, it often creates hidden compliance risk that surfaces only after CBSA intervenes. What feels simple at first can become expensive later.

Understanding when CLVS fits, and when it doesn’t, is critical for protecting your business as enforcement tightens.

If you’re importing regularly and relying on couriers, start with Clearit Canada’s Quick Start Guide to Stress-Free Importing.

FAQs

Is CLVS illegal for businesses?

No, but misuse and misclassification are.

Can CBSA reassess CLVS shipments?

Yes. CBSA can reassess past shipments if commercial intent is found.

Do low-value shipments avoid audits?

No. Repetition and patterns matter more than value.

Can I correct errors on CLVS entries?

Correction options are limited compared to formal commercial entries.

Are couriers responsible for compliance errors?

No. The importer is always responsible.

Is CLVS suitable for e-commerce sellers?

Only at very early, low-volume stages, and only temporarily.

Payment

Payment  My Account

My Account