For years, Canadian e-commerce sellers enjoyed a frictionless route into the U.S. market, small, frequent shipments valued under $800 that breezed through customs without duty or formal entry.

However, with the end of the U.S. de minimis threshold on the horizon, that era of effortless cross-border trade is nearing its end.

Today, success for Canadian exporters depends on something bigger, shifting from one-off parcels to smarter, consolidated bulk shipments.

Understanding the Shift: What the End of De Minimis Means

When the U.S. removes its $800 de minimis exemption (expected in 2025), all shipments, regardless of value, will require formal customs clearance, complete documentation, and accurate tariff classification.

That means:

- Higher brokerage and duty costs for parcel-level shipments

- More compliance oversight from U.S. Customs and Border Protection (CBP)

- Greater risk of delays if invoices or origin details are missing

For Canadian businesses selling into the U.S., adapting quickly will separate the efficient from the overwhelmed.

To get familiar with the new invoice expectations, review What to Include in a U.S.-Ready Commercial Invoice: A Canadian Importer’s Guide.

Why One-Off Shipping No Longer Works

Courier-based parcel shipping once offered simplicity — it was fast, trackable, and cost-effective for small orders. In a post-de minimis world, sending dozens of small parcels separately multiplies your compliance exposure:

- Every parcel becomes a separate entry requiring a commercial invoice and HS classification.

- Per-shipment fees from couriers and brokers add up quickly.

- Inconsistent documentation across orders increases audit risk.

In short: the strategy that once saved you time will soon cost you money.

- The Smarter Alternative: Consolidating Shipments

The most efficient way forward for Canadian sellers is shipment consolidation—combining multiple customer orders into a single bulk export for customs clearance.

As discussed in How Canadian E-Commerce Brands Can Lower Costs by Consolidating Shipments into the U.S., consolidation allows you to:

- Pay one clearance fee instead of dozens

- Simplify tariff classification and valuation under a single entry

- Reduce inspection frequency and cross-border delays

- Move inventory to a U.S. fulfillment partner for faster final delivery

This method transforms how SMBs compete, allowing even smaller brands to achieve enterprise-level efficiency.

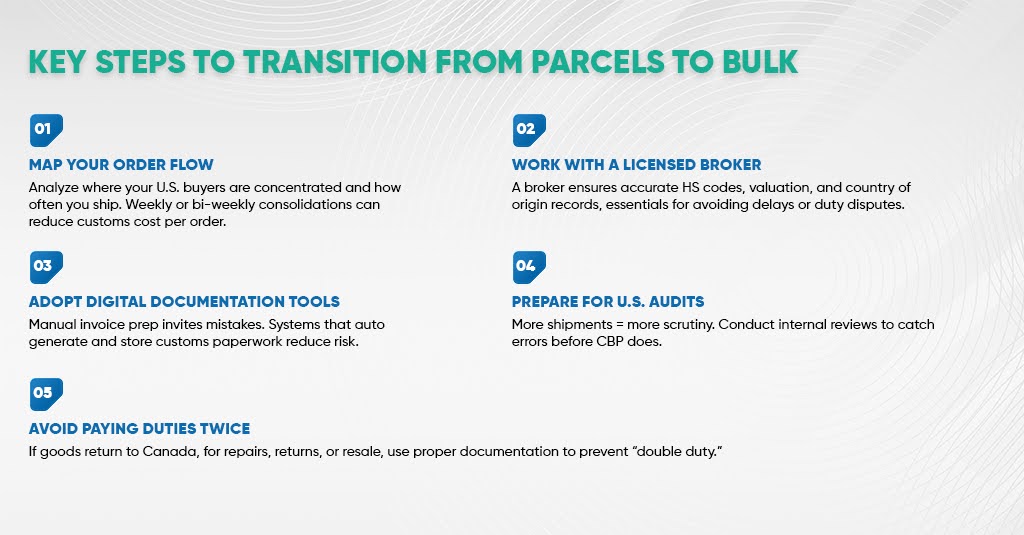

Key Steps to Transition from Parcels to Bulk

Map Your Order Flow

Analyze where your U.S. buyers are concentrated and how often you ship. Weekly or bi-weekly consolidations can reduce customs cost per order.

Work With a Licensed Broker

A broker ensures accurate HS codes, valuation, and country-of-origin records, essentials for avoiding delays or duty disputes.

Adopt Digital Documentation Tools

Manual invoice prep invites mistakes. Systems that auto-generate and store customs paperwork reduce risk.

See Our Quick-Start Guide to Stress-Free Importing for setup tips.

Prepare for U.S. Audits

More shipments = more scrutiny. Conduct internal reviews to catch errors before CBP does.

Learn how to get ready in The Rise of Audits: How Canadian Businesses Can Prepare for Stricter U.S. Enforcement.

Avoid Paying Duties Twice on Returned Goods

If goods return to Canada, for repairs, returns, or resale, use proper documentation to prevent “double duty.”

Our article Avoiding Double Duty: Canadian Importers Navigating Goods Returned from the U.S. explains how.

Compliance Essentials for Bulk Shipments

- Use clear, specific product descriptions (avoid vague terms like “apparel”).

- List HS codes and countries of origin for all items.

- Include importer of record (IOR) and consignee information for each shipment.

- Verify Incoterms (e.g., DDP or DAP) to clarify responsibility for duties.

- Retain records for at least 5 years, auditors may look back that far.

Failure to comply can trigger audits, delays, or penalties, risks that are easily avoided with standardized processes.

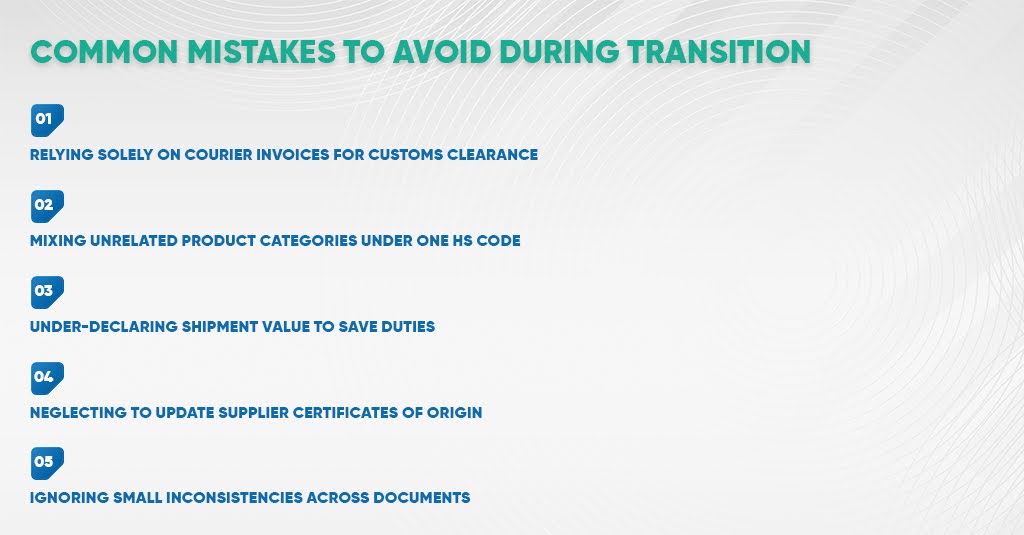

Common Mistakes to Avoid During Transition

- Relying solely on courier invoices for customs clearance

- Mixing unrelated product categories under one HS code

- Under-declaring shipment value to save duties

- Neglecting to update supplier certificates of origin

- Ignoring small inconsistencies across documents

Each of these issues can flag your shipment for inspection — costing you valuable time and damaging your reputation.

The Long-Term Advantage: Control, Cost, and Confidence

Consolidation isn’t just a defensive move — it’s a growth strategy.

When you ship in bulk, you gain:

- Predictable landed costs

- Better shipping rates from freight and logistics partners

- Improved tracking and reporting

- A stronger audit trail for CBP compliance

In essence, moving from reactive parcel shipping to proactive bulk logistics turns compliance into a competitive advantage.

Conclusion

The end of the $800 de minimis threshold doesn’t have to derail your U.S. growth — it simply requires smarter logistics.

Canadian sellers who consolidate, document accurately, and embrace digital customs processes will maintain speed and profitability in 2025 and beyond.

Don’t wait until new regulations take effect.

Start planning your consolidation strategy today to ensure every shipment clears quickly, compliantly, and cost-effectively.

Explore Our Quick-Start Guide to Stress-Free Importing to begin optimizing your cross-border process today.

FAQs

Q1: Is consolidation only for large exporters?

No. Even small Shopify or Amazon sellers can benefit by combining weekly orders into one shipment.

Q2: Will bulk shipping slow delivery times?

Not if paired with a U.S. fulfillment partner. Goods clear customs once, then ship domestically to buyers, often faster overall.

Q3: Do I need a U.S. business registration?

Not necessarily. Canadian companies can act as Non-Resident Importers (NRIs) and file entries directly.

Q4: How do I handle multiple product types in one shipment?

List each product separately with its own HS code and value on your commercial invoice.

Q5: What happens if I make a documentation mistake?

It can delay the release or lead to overpayment of duties. A licensed customs broker can help correct entries quickly.

Payment

Payment  My Account

My Account