As trade between Canada and the U.S. expands, refund claims under IEEPA tariffs and Section 1520(d) of USMCA have become increasingly important for cross-border businesses.

For Canadian exporters, proper documentation is not just paperwork, it’s the difference between a smooth refund process and costly delays.

In this article, we’ll walk Canadian exporters, SMBs, and logistics teams through the documentation needed to support U.S. refund claims, common challenges, compliance best practices, and how Clearit Canada Online Platform can help streamline the process.

Why Proper Documentation Matters

Refund claims allow U.S. importers to recover duties paid on certain qualifying goods, whether due to IEEPA tariff exemptions or USMCA preferential treatment.

However, CBP requires clear proof of origin, classification, valuation, and payment before granting a refund. If Canadian exporters fail to provide accurate or complete paperwork, U.S. buyers may face:

- Delayed or denied refunds

- Increased compliance scrutiny

- Lost cost savings that could impact pricing and competitiveness

- Refund delays can strain U.S.–Canada trade relationships, making U.S. buyers hesitant to continue sourcing from Canadian exporters

In short, the success of a refund claim depends heavily on the completeness and accuracy of documentation provided by Canadian exporters.

Case Example: A Jewelry Exporter’s Refund Delay

A Canadian jewelry exporter shipping items valued at $500 each to the U.S. faced a refund denial because certificates of origin were missing for several shipments. This cost their U.S. buyer thousands in unclaimed refunds and led to strained business relations.

Had they worked with Clearit Canada, our digital Platform would have ensured complete certificates and consistent HS code application, helping the buyer secure refunds on time and avoid future disputes.

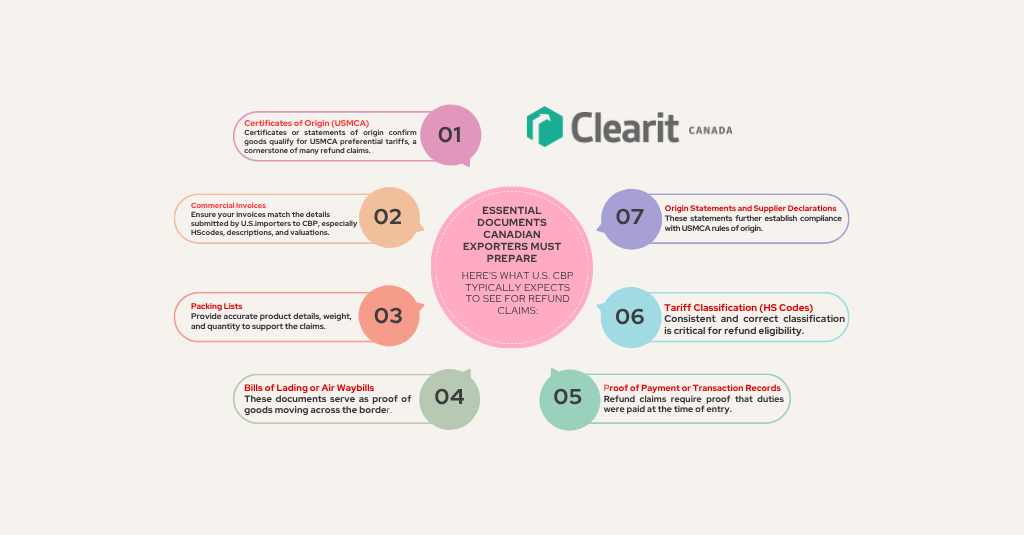

Essential Documents Canadian Exporters Must Prepare

Here’s what U.S. CBP typically expects to see for refund claims:

- Certificates of Origin (USMCA)

Certificates or statements of origin confirm goods qualify for USMCA preferential tariffs, a cornerstone of many refund claims. - Commercial Invoices

Ensure your invoices match the details submitted by U.S. importers to CBP, especially HS codes, descriptions, and valuations. - Packing Lists

Provide accurate product details, weight, and quantity to support the claims. - Bills of Lading or Air Waybills

These documents serve as proof of goods moving across the border. - Proof of Payment or Transaction Records

Refund claims require proof that duties were paid at the time of entry. - Tariff Classification (HS Codes)

Consistent and correct classification is critical for refund eligibility. - Origin Statements and Supplier Declarations

These statements further establish compliance with USMCA rules of origin.

Common Challenges Canadian Exporters Face

Even well-established exporters encounter pitfalls that jeopardize refunds:

- Misclassified HS codes leading to incorrect duty payments.

- Missing or incomplete proof of origin, especially with smaller or low-value shipments.

- Disorganized record-keeping, making it hard to produce documents for claims.

- Timing issues, such as failing to meet the deadlines for 1520(d) claims or overlooking short IEEPA-related windows.

Best Practices for Staying Compliant

To keep your cross-border operations refund-ready:

- Maintain digital records of all export documentation for at least five years.

- Leverage digital customs platforms to centralize and automate forms, reducing the risk of missing documentation.

- Coordinate closely with U.S. partners to align invoices, HS codes, and shipping data.

- Stay informed on Canada’s Duty Remission and Relief Programs to optimize tariff savings.

- Understand your compliance obligations as outlined in Importer Number vs. Business Number.

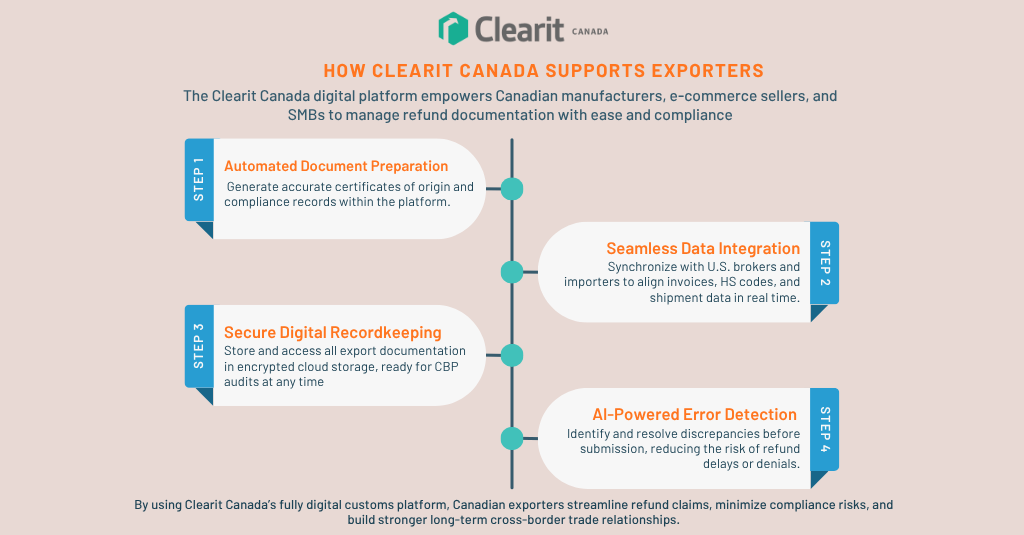

How Clearit Canada Supports Exporters

The Clearit Canada digital platform empowers Canadian manufacturers, e-commerce sellers, and SMBs to manage refund documentation with ease and compliance:

- Automated Document Preparation – Generate accurate certificates of origin and compliance records within the platform.

- Seamless Data Integration – Synchronize with U.S. brokers and importers to align invoices, HS codes, and shipment data in real time.

- Secure Digital Recordkeeping – Store and access all export documentation in encrypted cloud storage, ready for CBP audits at any time.

- AI-Powered Error Detection – Identify and resolve discrepancies before submission, reducing the risk of refund delays or denials.

By using Clearit Canada’s fully digital customs platform, Canadian exporters streamline refund claims, minimize compliance risks, and build stronger long-term cross-border trade relationships.

Related Reading for Canadian Exporters

Explore these additional resources to stay ahead in cross-border compliance:

- Learn about The Most Imported Product Categories in Canada and their customs requirements.

- See how Digital Customs Modernization is shaping trade efficiency.

- Optimize your tariff savings with Canada’s Duty Remission and Relief Programs.

FAQs

1. Why do U.S. buyers need refund claims?

Refund claims allow U.S. importers to recover duties paid on qualifying goods, particularly under USMCA 1520(d) or during IEEPA tariff adjustments.

2. Do all Canadian goods exported to the U.S. qualify for refunds?

No. Eligibility depends on rules of origin, tariff classifications, and timely submission of claims.

3. How long should Canadian exporters retain records?

Best practice is to keep documentation for at least five years to comply with CBP and Canadian customs requirements.

4. Can Clearit Canada help with both initial exports and refund claims?

Yes. Clearit Canada assists from documentation preparation to ongoing support for refund filings in coordination with U.S. brokers.

5. What documents do Canadian exporters need for U.S. refund claims?

Canadian exporters must provide:

- A valid USMCA Certificate of Origin or origin statement

- Commercial invoices with correct HS codes and product descriptions

- Packing lists with quantities, weights, and details

- Bills of lading or air waybills showing shipment across the border

- Proof of duty payment (CBP Form 7501 and entry summary)

- Supplier declarations or origin statements confirming compliance

6. How long does it take to process a U.S. duty refund?

U.S. duty refund claims typically take 3 to 6 months for straightforward cases. More complex claims requiring additional documentation or CBP review may take up to 12 months.

7. Can small or low-value shipments qualify for U.S. refund claims?

Yes, but they often face more challenges. Low-value shipments frequently lack Certificates of Origin or detailed invoices, which can cause refunds to be denied. To avoid this, exporters should prepare complete documentation regardless of shipment size.

Don’t let missing paperwork jeopardize your U.S. refund opportunities or your buyer relationships.

Partner with Clearit Canada to ensure your documentation is accurate, compliant, and refund-ready.

Payment

Payment  My Account

My Account