What is a “Reason to Believe” deadline?

As defined in Memorandum D11-6-6, refers to the case in which incorrect information provided for an imported shipment (origin, classification, value of duty, etc.) are deemed believable and not the fault of the importer. In this scenario, the importer or broker may submit the corrections to the documentation within a 90-day period.

On the deadline, the memorandum states:

“For example, the date a supplementary invoice was received from a vendor indicating a price increase for imported goods already declared or, the date of accounting where assists were provided prior to the production of the imported goods.”

It will not come as a surprise to anyone in the importing/exporting industry — newcomers and seasoned pros alike — that there is a lot of documentation required in moving goods into Canada. CBSA requires importers to be well-versed in the requirements surrounding the commercial goods being brought into the Country.

On their website, under their guide to: “Importing commercial goods into Canada”, it is clearly listed the main categories of documentation/regulatory understanding required:

- Goods classification

- Determining duties and taxes

- Reporting goods

- Country of origin for the goods

- If the goods are permitted into Canada

- Any additional permits required, restrictions, or regulations to be followed

This is a lot of information to ensure the accuracy of! As such, CBSA provides some leniency to importers on pieces of info like the goods classification, origin of goods, or the valuation of the goods.

In an article published on Clearit Canada’s blog a few weeks ago, as importers and other sub-sectors in the logistics industry are working from home as a result of the ongoing pandemic, documentation errors may be more likely to occur.

From Importers & Remote Work: Mistakes To Watch Out For: “With so much up in the air right now, it is difficult to keep track of these deadlines.”

Recommended reading: Looking at Canadian Trade From The Lense of COVID-19

More on the timeframe

All things considered, the Reason to Believe deadline for correction remains 90 days. While a few changes to the importing regulatory framework has been put into place as a result of COVID-19, extending this deadline has not been one of them. So, please note that, regardless of the global condition, the deadline is still 90 days.

Challenging a CBSA decision/further-redetermination

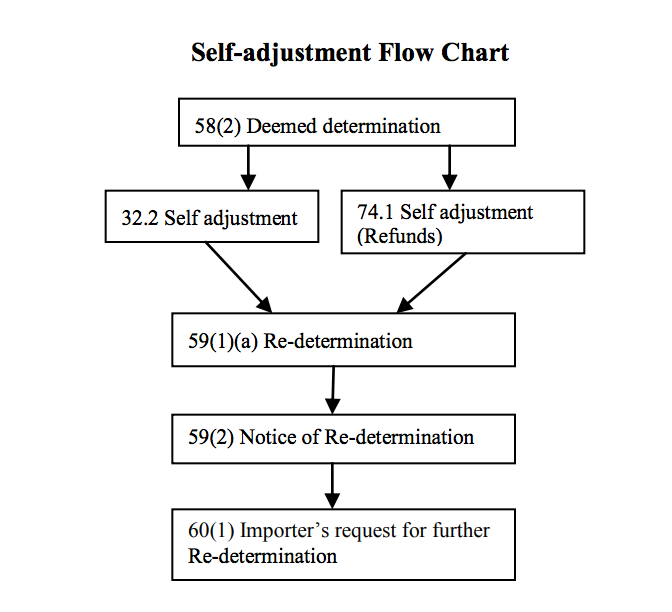

Along with the details regarding the time frame and types of errors to correct, the memorandum also outlines the actual process/steps to submit a correction to CBSA — and then re-submitting a following correction. Beginning with “deemed determination”:

At what cost (penalties)?

Simply put, CBSA reserves the right to penalize importers that have reason to believe but don’t file within the appropriate time frame of 90 days. Beware: the penalties can be quite costly! The amount payable will be determined by the Administrative Monetary Penalty System (AMPS).

It is definitely a good thing that importers have recourse in correcting any potential errors put forth in the required documentation by CBSA. However, CBSA has indeed been criticized for not extending the 90 day time frame.

At times, it can be tricky to collect and submit all the correct documentation in due course for a commercial shipment — especially in hectic times like these. As such, partnering with a reputable customs broker can help ease the process and limit the possibility of penalties or fines saving businesses ever-important cash flow.

If you’re interested in learning more about the process of partnering with a customs broker, you can start a no-commitment conversation here.

Payment

Payment  My Account

My Account